SIGTARP-10-003

SIGTARP-10-003

- 47 pages

- November 17, 2009

In the fall of 2008, the Federal Reserve and Treasury faced several key decisions about the future of AIG. After attempts to find private-sector financing failed, they chose to provide assistance to AIG rather than allow the company to file for bankruptcy. FRBNY officials believed that an AIG failure would pose considerable risk to the entire financial system and would have significantly intensified an already severe financial crisis. FRBNY was concerned about the effect of an AIG bankruptcy on key sectors of the market, such as retirement accounts and the credit markets. FRBNY adopted in substantial part the economic terms of a draft term sheet under consideration by a consortium of private banks, the terms of which included a very high interest rate. When it became apparent that AIG’s liquidity crisis would continue despite FRBNY financing and that a further downgrade was coming, to avoid such a downgrade the Federal Reserve and Treasury decided to create a special purpose vehicle, called Maiden Lane III, that bought the underlying collateral of a portion of AIG’s credit default swaps from a number of AIG’s counterparties. Terminating these credit default swaps in this way prevented further collateral calls and eased AIG’s liquidity pressures.

After limited efforts to negotiate concessions from the counterparties failed, FRBNY decided to pay AIG’s counterparties at what was effectively face or “par value” — the fair market value of the counterparty assets plus the collateral payments they had already received — for the collateralized debt obligations underlying AIGFP’s credit default swap portfolio. FRBNY was confronted with a number of factors that it believed limited its ability to negotiate reductions in payments effectively, including a perceived lack of leverage over the counterparties because the threat of an AIG bankruptcy had already been removed by FRBNY’s previous assistance to AIG. On March 15, 2009, after significant public and Congressional pressure, AIG, after consultation with the Federal Reserve, publicly disclosed the identities of the counterparties. FRBNY officials state that they believe they will recoup the loan they made to Maiden Lane III over time. As of September 30, 2009, the current fair market value of the Maiden Lane III portfolio is $23.5 billion versus a loan balance of $19.3 billion.

Conclusions and Lessons Learned

SIGTARP concludes that: (1) the original terms of federal assistance to AIG, including the high interest rate it adopted from the private bank’s initial term sheet, inadequately addressed AIG’s long term liquidity concerns, thus requiring further Government support; (2) FRBNY’s negotiating strategy to pursue concessions from counterparties offered little opportunity for success, even in light of the willingness of one counterparty to agree to concessions; (3) the structure and effect of FRBNY’s assistance to AIG, both initially through loans to AIG, and through asset purchases in connection with Maiden Lane III effectively transferred tens of billions of dollars of cash from the Government to AIG’s counterparties, even though senior policy makers contend that assistance to AIG’s counterparties was not a relevant consideration in fashioning the assistance to AIG; and (4) while FRBNY may eventually be made whole on its loan to Maiden Lane III, it is difficult to assess the true costs of the Federal Reserve’s actions until there is more clarity as to AIG’s ability to repay all of its assistance from the Government. SIGTARP also draws lessons that should be learned regarding the importance of transparency and the enormous impact that ratings agencies had on the AIG bailout.

…

In September 2008, multiple U.S. financial institutions had failed or were on the brink of failure as a result of an escalating crisis in the financial markets. This ultimately led to enactment of the Emergency Economic Stabilization Act of 2008 (“EESA”), which provided the Department of the Treasury (“Treasury”) with $700 billion to aid financial institutions under the Troubled Asset Relief Program (“TARP”). One of the companies that received the greatest assistance under TARP, and even greater assistance from the Federal Reserve Bank of New York (“FRBNY”), pursuant to the authorization of the Board of Governors of the Federal Reserve System (“Federal Reserve Board”, and, collectively with FRBNY, “Federal Reserve”), was the insurance conglomerate American International Group (“AIG”). Beginning in 2007, AIG began experiencing a significant drain on its finances when, among other things, the company began paying increasing amounts of collateral1 to counterparty institutions that had purchased insurance-like contracts called credit default swaps from AIG’s subsidiary, AIG Financial Products (“AIGFP”).

By September 2008, bankruptcy loomed for AIG, in part because AIG was unlikely to be able to raise the capital needed to meet additional calls for large collateral payments in the case of an anticipated downgrade in its credit rating by credit rating agencies. On the afternoon of September 15, 2008, the three largest credit rating agencies—Standard and Poor’s Financial Services, Moody’s Investors Service, Inc., and Fitch Ratings Ltd.—downgraded AIG. On September 16, 2008, because of concerns that an AIG bankruptcy could cause systemic risk to the entire financial system and the American retirement system, the Federal Reserve Board, with the support of Treasury, authorized FRBNY to lend up to $85 billion to the firm under Section 13(3) of the Federal Reserve Act.4 This would be the first of several infusions of capital and loans to AIG, first by the Federal Reserve and then by Treasury.

Despite this initial Government assistance, AIG’s financial difficulties continued, and there were concerns that a further downgrade was forthcoming. Additional downgrades, among other things, could trigger requirements for AIG to make additional collateral payments (referred to as “posting collateral”) to AIG’s counterparties. The downgrades could thus exacerbate the liquidity drain and the payments to swap counterparties. To help prevent further downgrades of AIG’s credit rating that could lead to a disorderly bankruptcy with potentially destabilizing effects for the U.S. economy, in November 2008, the Federal Reserve and Treasury announced a restructuring of their official assistance. Among other measures, the Federal Reserve Board authorized FRBNY to create a special purpose vehicle (“SPV”) called Maiden Lane III and to lend it up to $30 billion to buy collateralized debt obligations (“CDOs”) underlying the credit default swaps from AIG’s counterparties. In connection with this purchase, AIG’s counterparties agreed to terminate the associated swaps with AIG in return for retaining collateral they had already received. This eliminated any future need for AIG to post additional collateral or make future payments on the credit default swaps related to the CDOs purchased by Maiden Lane III. The combination of the two components of the transaction equaled effectively the par (or face) value of the credit default swaps. Once these payments became publicly known, questions were raised about the propriety of paying the counterparties the equivalent of par value because the market value of the underlying CDOs had dropped precipitously and because some counterparties were already recipients of Treasury funding under TARP and the beneficiaries of other federal bailout programs. Likewise, there were questions whether these counterparty payments may also effectively have been paid using Government funding as a “backdoor bailout” of these counterparties.

Background

AIG is a global organization doing business in more than 130 countries and jurisdictions. In 2007, it was ranked the largest life insurer and the second largest property/casualty insurer by premiums written in the United States.7 AIG offers a broad spectrum of insurance and asset management services. AIG’s 116,000 employees work in four principal business units:

• Financial Services

• Asset Management

• Life Insurance & Retirement Services

• General InsuranceAIGFP, AIG’s Financial Products subsidiary, offered a portfolio of products that included credit default swaps. Credit default swaps are insurance-like instruments that AIGFP issued to counterparty buyers such as financial institutions and investors. Under a credit default swap, AIG would receive a series of payments from the counterparties in return for AIG agreeing to make a payment to the counterparties if a particular defined credit event occurred with respect to an underlying security (for example, if the credit rating on a security is downgraded or the security goes into default). Credit default swaps are often used to hedge against a loss in value of asset-backed securities.8 AIGFP sold credit default swaps that offered loss protection on assets such as multi-sector CDOs. CDOs are financial instruments that entitle the buyer to some portion of cash flows from a portfolio of assets, which may include bundles of bonds, loans, mortgage-backed securities, or even other CDOs.9 A multi-sector CDO is a CDO backed by a combination of corporate bonds, loans, mortgages, or asset-backed securities. Under the terms of AIGFP’s credit default swap contracts, the counterparties purchasing the credit default swaps paid AIG regular insurance-like premiums and were entitled to require AIGFP to post collateral when certain events occurred relating to the underlying CDOs, including a decline in the market value of the CDO.10 In addition, if the credit rating on the underlying CDOs were downgraded, AIGFP could also be required to post collateral. The credit default swap contracts also included collateral posting provisions that provided that certain

events related to AIG would also trigger an obligation for AIGFP to pay the counterparties cash collateral as evidence of AIGFP’s ability to pay the counterparty in the event of a default. For example, a common provision provided that, in the event AIG’s credit rating was downgraded, AIGFP would have to post cash collateral to ensure payment. The amount of cash collateral AIGFP was required to post differed for each event and was calculated based on AIGFP’s credit rating, the rating of the underlying security, the market value of the underlying security, and other terms set forth in the swap contract.Although credit default swaps are sometimes referred to as insurance-like contracts, they are not technically considered insurance, and, unlike insurance contracts, credit default swaps are not regulated. As a result, AIGFP was not required to hold reserves to cover losses or other claims as it would if it was selling insurance policies. AIGFP was thus able to sell swaps on $72 billion worth of CDOs to counterparties without holding reserves that a regulated insurance company would be required to maintain if it had written an equivalent amount of insurance coverage. Counterparties assumed that AIG, which was a highly rated company at the time it wrote the swaps, would be able to pay any claims on the swaps that might occur as required by the contracts.

Beginning in the third quarter of 2007 and continuing through 2008, AIG’s financial condition deteriorated, causing a decline in market confidence that, in turn, triggered downgrades of AIG’s credit rating. At the same time, the market value of the CDOs protected by AIGFP’s credit default swaps declined. As a result, AIGFP was required to post collateral under the terms of its credit default swap contracts, typically the difference between the market value of the underlying CDO and its par value. By late summer 2008, however, AIG did not have nearly enough liquidity to post the required collateral and was on the verge of defaulting on its obligations to its counterparties, which would likely have forced AIG into bankruptcy. In response to the possible systemic implications and the potential for significant adverse effects on the economy if AIG failed, on September 16, 2008, the Federal Reserve Board, with the support of Treasury, authorized FRBNY to lend up to $85 billion to assist AIG in meeting its obligations and to facilitate the orderly sale of some of its businesses.

As AIG continued to experience problems in the fall of 2008, AIG received further government assistance. In November 2008, Treasury purchased $40 billion of newly issued AIG preferred shares under TARP’s Systemically Significant Failing Institutions program. These funds went directly to FRBNY to pay back a portion of the funds previously provided to AIG by FRBNY and permitted FRBNY to reduce the total amount available under the credit facility from $85 billion to $60 billion.

At the same time, the Federal Reserve Board announced a number of other measures intended to put AIG on sounder financial footing. These included authorizing FRBNY to restructure the terms of its credit facility to AIG and to create, and lend to, an SPV called Maiden Lane II that was designed to resolve liquidity pressures stemming from AIG’s securities lending programs.

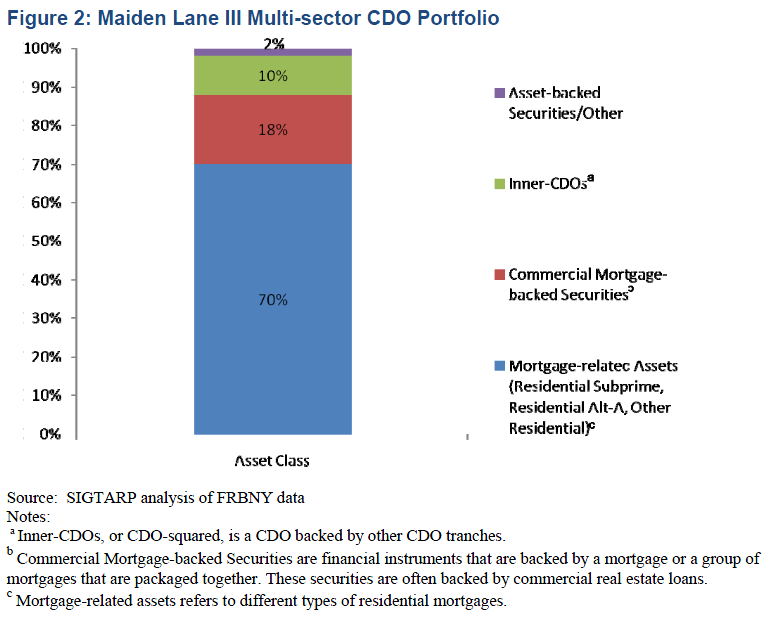

The Federal Reserve Board further authorized FRBNY to create, and lend up to $30 billion to, Maiden Lane III to buy the underlying CDOs from AIG’s counterparties. These purchases were part of a transaction in which the counterparties, in exchange for agreeing to terminate their credit default swap contracts, would be allowed to retain collateral previously posted by AIG. Pursuant to this Federal Reserve Board authorization, Maiden Lane III was funded with $24.3 billion from FRBNY in the form of a senior loan and a $5 billion equity investment from AIG. Maiden Lane III paid the fair market value of the multi-sector CDOs, or $29.6 billion, in exchange for receiving CDOs with an approximate face value of $62.1 billion. Of the fair market value amount paid by Maiden Lane III, $27.1 was paid to counterparties and $2.5 billion

was paid to AIGFP as an adjustment payment to reflect overcollateralization. In simultaneous transactions, the counterparties were allowed to keep the $35 billion in collateral that had been posted by AIG prior to the transaction in exchange for tearing up the associated credit default swap contracts. That collateral was funded in part by the original $85 billion line of credit advanced by FRBNY. As a result of combining the fair market value purchase of the CDOs and the retention of collateral postings already received from AIG, AIG’s counterparties received $62.1 billion overall, effectively the par value of the credit default swaps. No TARP funds were directly used in the Maiden Lane III transaction.…

Key Decisions That Led to the Creation of

Maiden Lane III

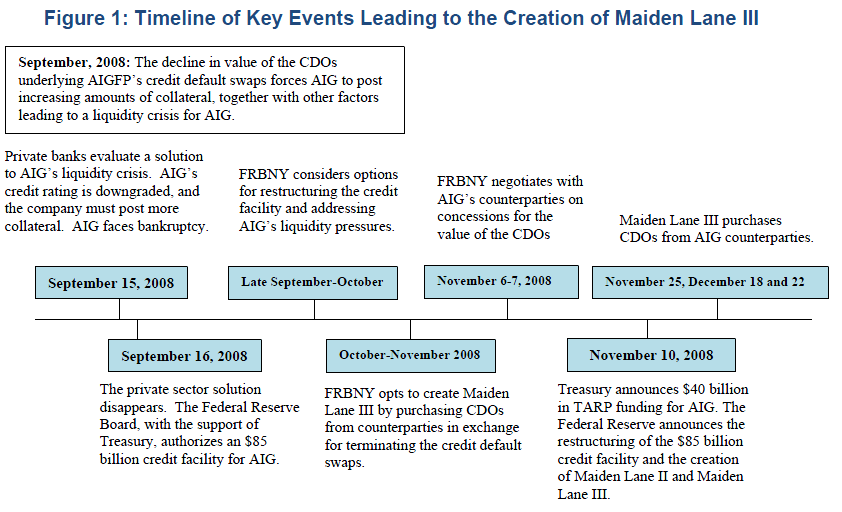

This section addresses the circumstances and decisions that led to the creation of Maiden Lane III. AIG began suffering significant liquidity problems in September 2008 when it was required to post collateral to its counterparties to make up for, among other things, the rapidly declining value of the securities underlying its credit default swaps. On September 15, 2008, AIG’s longterm credit rating was downgraded, and, without some kind of assistance, the company faced bankruptcy. FRBNY believed that a consortium of private banks would be able to offer assistance to AIG. The consortium, however, believed AIG’s liquidity needs exceeded the value of the company’s assets, and the private sector solution failed in the wake of the bankruptcy of Lehman Brothers. After the prospect of receiving private sector financing disappeared, AIG turned to the Federal Reserve. The Federal Reserve and Treasury considered the benefits of supporting AIG, including the impact that an AIG failure could have on the financial system as a

whole and the risks of supporting AIG, which included increasing moral hazard. Because Federal Reserve and Treasury officials believed that an AIG bankruptcy could ultimately have a greater systemic impact than Lehman’s bankruptcy one day before, they decided that additional Federal support was needed to maintain the overall stability of the financial markets. On September 16, 2008, the Federal Reserve Board authorized FRBNY to extend an $85 billion revolving credit facility to AIG. In a rush to take action quickly, FRBNY did not craft its own terms and instead simply adopted in substantial part the economic terms of a draft term sheet under consideration by a consortium of private banks, which included a very high interest rate. The terms of this agreement, including the substantial increase in the amount of AIG debt and the substantial interest rate, would later put AIG’s credit rating in jeopardy once again, requiring additional Government action. FRBNY further determined that addressing AIG’s credit default swap portfolios and assuming liabilities associated with AIG’s most problematic credit default swap obligations, which continued to be a drain on AIG’s liquidity, would be critical to any restructuring of the original agreement. Therefore, on November 10, 2008, the Federal Reserve Board authorized FRBNY to create Maiden Lane III to purchase the CDOs underlying certain credit default swap contracts from the counterparties. Figure 1 shows the timeline of events discussed in this section.