BlackRock Solutions

BlackRock Solutions

- 61 pages

- Confidential

- Restricted F.R.

- October 30, 2008

This presentation outlines a structure (“Maiden Lane III”) to resolve the liquidity drain at AIG from the multi-sector CDO book (primarily U.S. subprime mortgage exposure)

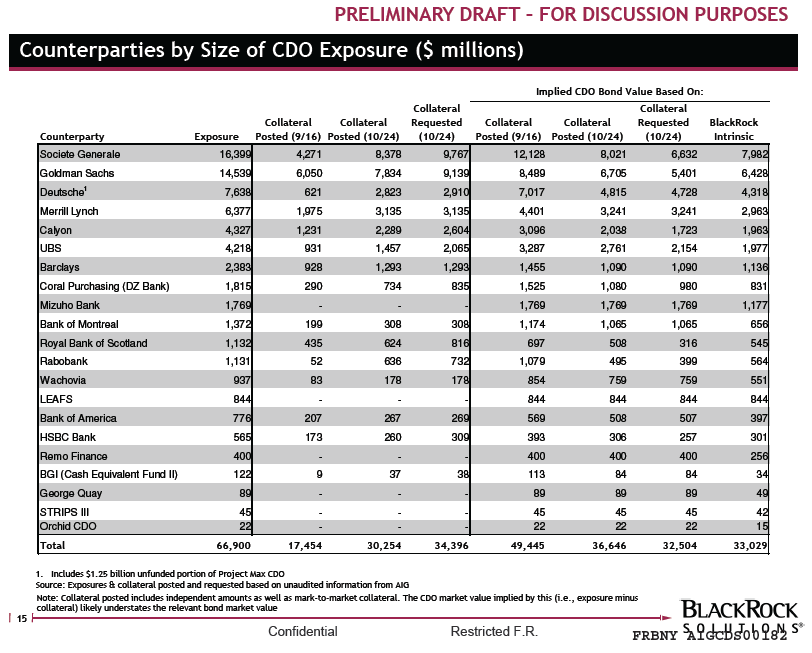

The problem stems from mark-to-market collateral requirements imbedded in AIG’s credit derivative swaps tied to ABS CDOs

• Unlike standard monoline contracts on ABS CDOs, AIG committed to post collateral tied to the current market value of the reference obligation (the CDOs)

• The marks on these CDOs are severely distressed, incorporating very high / illiquid discount rates

• Rating downgrades (on both AIG and the CDOs) have amplified these posting requirements

• As of 10/24, AIG has posted $30.25 billion, with counterparties demanding an additional $4.2 billionFederal Reserve, BlackRock, Davis Polk, E&Y, and Morgan Stanley staff collaborated to create a structure designed to:

• Eliminate the liquidity drain while mitigating the capital impact on AIG

• Ensure the FRBNY is repaid in all scenarios (iron constraint)

• Avoid AIG’s consolidating the facility but still enable AIG to retain some upside (fair dealing, satisfying rating agencies)BlackRock was engaged by AIG in July 2008 to model this exposure and advise AIG on its workout (95 cash CDOs, ~10,000 underlying bonds, hundreds of thousands of underlying loans)

In early October 2008, the FRBNY requested BlackRock’s confidential advice in structuring and modeling a workable solution on this problem

…