Bank of England/ECB Conference on “Payments and monetary and financial stability”

Bank of England/ECB Conference on “Payments and monetary and financial stability”

- Denis Beau, Chairman of the CPSS working group on system interdependencies

- 10 pages

- November 12-13, 2007

What are interdependencies, and Why do they matter?

Interdependencies arise when the settlement flows, operational processes or risk management procedures of one system are related to those of other systems

Interdependencies potentially can simultaneously:

•Improve the safety and efficiency of payment and settlement processes

•Allow financial disruptions to be passed more easily and more quickly across systems, their participants and related markets, accentuating their role in transmitting disruptions (Ferguson report)Forms of interdependencies

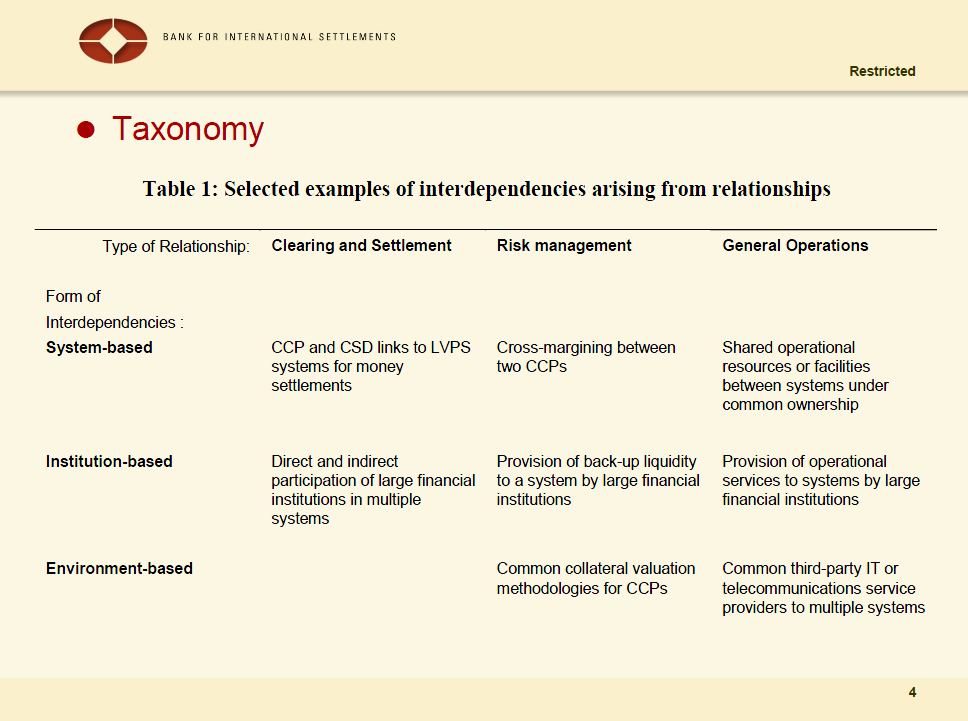

Interdependencies arise from:

•Direct relationships among systems

•Indirect relationships among systems due to the activities of financial institutions,

•“Environmental” factors: the dependence of multiple systems on common third-parties, on common markets, etcThat reflect multiple activities and purposes:

•Clearing and settlement channels/arrangements

•Operational processes and facilities

•Risk management…

…

Factors influencing interdependencies

Four key and interrelated forces and policies:

•Globalisation and regional integration

•Consolidation

•Public policies

•Technological innovationsThe influence of these forces and polices take place in the context of the effort of central banks and other authorities together with market participants to increase efficiency and reduce risks in systems.

Central banks have promoted some forms of interdependencies, particularly system-based (egDVP and PVP links)

Extent of Interdependencies

Interdependencies are particularly strong on a domestic basis

•Comprehensive web of clearing and settlement relationships amongkey domestic systems (CCP to CSD, CCP to LVPS, LVPS to CSD)

•Significant overlap in the participant base of domestic systems,leading to strong interdependencies of liquidity flows across systems

•To a lesser degree, some reliance on common service providers, and some risk-management links (cross-margining, common default definitions, etc)Focused interdependencies on a cross-border basis

•CLS-related relationships are well known

•Widespread reliance on SWIFT

•But, role of institution-based links currently less clear; may continue to grow in importance going forwardImplications for risks in payment and settlement systems

Specific sources of several risks have been eliminated, or reduced

•Principal credit risk: implementation of DVP and PVP

•Operational risk: links among systems can help with STP

•Liquidity risk and settlement asset risk: central bank money haslower credit risk and liquidity risk (more assurance in its provision vscorrespondents)But, new sources of risk have been introduced

•These risks are often cross-system in nature, meaning that a disruption in one system may have direct implications for the smooth functioning of a second system

•Obvious examples at the system level (DVP links, CLS, etc); but,can also be at the institution level if flows in one system are conditional on those in anotherAnd, concentration in the sources of risks have been accentuated

•Multiple systems now face common risks from key systems (RTGS), large financial institutions, and key service providers (egSWIFT)Implications for transmission of disruptions

Specific sources of several risks have been eliminated, or reduced

•Principal credit risk: implementation of DVP and PVP

•Operational risk: links among systems can help with STP

•Liquidity risk and settlement asset risk: links among systems facilitate the use of central bank moneyBut, new sources of risk have been introduced

•These risks are often cross-system in nature, meaning that a disruption in one system may have direct implications for the smooth functioning of a second system

•Obvious examples at the system level (DVP links, CLS, etc); but,can also be at the institution levelAnd, concentration in the sources of risks have been accentuated

•Multiple systems now face common risks from key systems (RTGS), large financial institutions, and key service providers (egSWIFT)