United States District Court, Southern District of Texas, Houston Division

- 57 pages

- June 18, 2009

1. Stanford Financial Group (SFG) was the parent company of Stanford International Bank, Ltd. and a web of other affiliated financial services entities, including Stanford Group Company. SFG maintained offices in several locations, including Houston, Texas, Memphis, Tennessee, and Miami, Florida.

2. Stanford International Bank, Ltd. (SIBL) was a private, offshore bank with offices on the island of Antigua and elsewhere. SIBL was organized in or about 1985 in Montserrat, originally under the name of Guardian International Bank. In or about 1989, SIBL’s principal banking location was moved to Antigua.

3. SIBL’s primary investment product was marketed as a “Certificate of Deposit” (CD). SIBL marketed CDs to investors promising substantially higher rates of return than were generally offered at banks in the United States from 2001 to 2008. In its 2007 Annual Report to investors, SIBL purported to have approximately $6.7 billion worth of the CD deposits and over $7 billion in total assets. In its December 2008 Monthly Report, SIBL purported to have over 3 0,000 clients from 131 countries representing $8.5 billion in assets.

4. Stanford Group Company (SGC), a Houston-based company, was founded in or about 1995. SGC was registered with the Securities and Exchange Commission (SEC) as a broker-dealer and investment advisor. SGC was also a member of the Financial Industry Regulatory Agency, formerly the National Association of Securities Dealers, and the U.S. Securities Investor Protection Insurance Corporation (SIPIC). Although SGC and the financial advisers employed by SGC promoted the sale of SIBL’s CDs through SGC’s 25 offices located throughout the United States, SIBL’s CDs were not insured by SIPIC or the Federal Deposit Insurance Corporation (FDIC).

5. In Antigua, SIBL was purportedly regulated by the Financial Services Regulatory Commission (FSRC), an agency of the Antiguan government, and was subject to annual on-site inspection by the FSRC. The FSRC claimed on its website that it conducted these inspections to determine the solvency of the banks, review the quality of the investments, and review the accuracy of the banks’ returns. Annually, SIBL provided to the FSRC an “Analysis of Investments” report which listed purported values for SIBL’s investments. FSRC did not, however, audit SIBL’s financial statements or verify the value SIBL ascribed to its investments in the Analysis of Investments.

6. Defendant ROBERT ALLEN STANFORD controlled SFG and its affiliated companies, including, through a holding company, SIBL. STANFORD was the chairman of the SIBL Board of Directors and a member of SIBL’s Investment Committee. STANFORD, among other things, received regular updates and financial reports on the investment activities of SIBL; made hiring decisions for SIBL; made decisions about what revenue and asset numbers to report to investors and others; made investment decisions for SIBL; updated investors and others about the activities and financial status of SIBL; and approved reports to investors and

others about the financial condition of SIBL. STANFORD also authorized SIBL to make loans to himself and authorized SIBL to purchase property from STANFORDcontrolled entities and to sell property to STANFORD-controlled entities.7. JAMES M. DAVIS, a co-conspirator not named as a defendant herein, was the Chief Financial Officer (CFO) for SFG and SIBL, and served as a member of SIBL’s Investment Committee. DAVIS, among other things, regularly consulted with STANFORD about the financial status of SIBL, including investment decisions; received regular updates on SIBL’s revenue and loss records; made decisions, based on the direction of STANFORD, about what revenue and asset numbers to report to investors and others; updated investors and others about the financial status and operations of SIBL; and approved reports to investors and others about the financial condition of SIBL.

8. Defendant LAURA PENDERGEST-HOLT was the Chief Investment Officer (CIO) of SFG. In or about December 2005, HOLT was appointed by the SIBL Board of Directors as a member of SIBL’s Investment Committee. PENDERGEST-HOLT, among other things, held herself out to investors, employees of SIBL and SFG, and others as managing the entire investment portfolio of SIBL; updated investors and employees of SIBL and SFG regarding the financial Status of SIBL; provided information about SIBL’s investment portfolio to SFG and SGC financial brokers; and supervised SFG research analysts.

9. Defendant GILBERTO LOPEZ was the Chief Accounting Officer of SFG. LOPEZ, among other things, was responsible for tracking SIBL revenues, assets and liabilities, and was responsible for the preparation of the revenue and asset numbers used in SIBL’s financial reports.

10. Defendant MARK KUHRT was the Global Controller for Stanford Financial Group Global Management, an affiliate of SFG and SIBL. KUHRT, among other things, maintained calculations of investment revenue of SIBL and, along with LOPEZ, was responsible for the preparation of the revenue and asset numbers used in SIBL’s financial reports.

11. Defendant LEROY KING was the Administrator and Chief Executive Officer for the FSRC. KING, among other things, was responsible for Antigua’s regulatory oversight of SIBL’s investment portfolio, including the review of SIBL financial reports for the Antiguan Government, and the response to requests by foreign regulators, including the SEC, for information and documents about SIBL’s operations.

…

False Statements Regarding Oversight by Antiguan Regulators:

d. STANFORD, KING, DAVIS and others would make false and misleading representations regarding the nature and extent of regulatory oversight of SIBL, including that SIBL’s operations and financial condition were being scrutinized by the FSRC in Antigua and that SIBL’s financial statements were subject to annual audits and regulatory inspections by Antiguan regulators, when, in truth and in fact, STANFORD had made corrupt payments to KING in order to ensure that the FSRC did not accurately audit SIBL’s financial statements or verify the existence or value of SIBL’s assets as reflected in the SIBL financial statements.

…

65. On or about January 31, 2007, KING caused a deposit to be made in the amount of approximately $4,000 in U.S. currency into a bank account he controlled in Tucker, Georgia.

66. On or about March 19, 2007, KING caused a deposit to be made in the amount of approximately $6,000 in U.S. currency into a bank account he controlled in Hallandale, Florida.

67. In or about April 2007, STANFORD and DAVIS caused to be sent to investors and placed on SIBL’s website SIBL’s Annual Report for 2006, which included representations that SIBL’s total assets at year end 2006 were up 31.5% to $5.3 billion, with an “operating profit of $28.8 million,” and which also included a Report of Management signed by STANFORD and DAVIS.

68. On or about April 16, 2007, KUHRT sent an email from Houston, Texas, to DAVIS in Tupelo, Mississippi, with a copy to LOPEZ, in Houston, Texas, which attached a falsely inflated March 2007 revenue entry for SIBL.

69. On or about April 16, 2007, KING caused a deposit to be made in the amount of approximately $9,000 in U.S. currency into a bank account he controlled in Chamblee, Georgia.

70. In or about June 2007, STANFORD, HOLT, and DAVIS caused a newsletter, called the Stanford Eagle, to be sent to investors in which representations were made that SFG had “worldwide assets under management or advisement” exceeding $43 billion and which touted the “Stanford Investment Model” as one in which they would “carefully consider asset classes, investment strategies, sectors and regions of the world that most investors either don’t have easy access to or rarely get information about.”

71. On or about September 14,2007, KING caused a deposit to be made in the amount of approximately $5,500 in U.S. currency into a bank account he controlled in Tucker, Georgia.

72. On or about December 24, 2007, KING caused a deposit to be made in the amount of approximately $4,470 in U.S. currency into a bank account he controlled in Tucker, Georgia.

73. On or about January 23, 2008, KING caused a withdrawal to be made in the amount of approximately $15,000 from a bank account he controlled in New York, New York and deposited the money into an investment account in New York.

74. On or about January 30,2008, KING caused a deposit to be made in the amount of approximately $9,500 in U.S. currency into a bank account he controlled in Tucker, Georgia.

…

COUNT TWENTY-ONE

Conspiracy to Commit Money Laundering1. Paragraphs 1 through 33 and 36 through 39 of Count One of this Indictment are re-alleged and incorporated by reference as though fully set forth herein.

THE CONSPIRACY TO COMMIT MONEY LAUNDERING

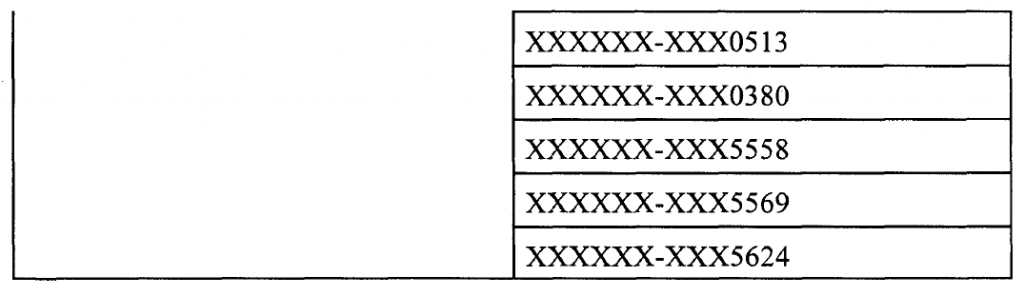

2. Beginning in or around at least September 1999, the exact date being unknown to the Grand Jury, through on or about February 17, 2009, in the Southern District of Texas and elsewhere, the defendants,ROBERT ALLEN STANFORD

a/k/a Sir Allen Stanford

a/k/a Allen Stanford,

LAURA PENDERGEST-HOLT

a/k/a Laura Pendergest

a/k/a Laura Holt,

GILBERTO LOPEZ,

MARKKUHRT

and

LEROY KING,did knowingly and intentionally conspire, combine, confederate, and agree with each other, with JAMES DAVIS, and with others, known and unknown to the Grand Jury, to transport, transmit, or transfer a monetary instrument and funds from a place in the United States to or through a place outside the United States, or to a place in the United States from or through a place outside the United States, with the intent to promote the carrying on of specified unlawful activity, that is, wire fraud, mail fraud, and securities fraud, in violation of Title 18, United States Code, Section 1956(a)(2)(A).

MANNER AND MEANS OF THE CONSPIRACY

The manner and means by which the defendants and their co-conspirators sought to accomplish the objects of the conspiracy included, among others, the following:

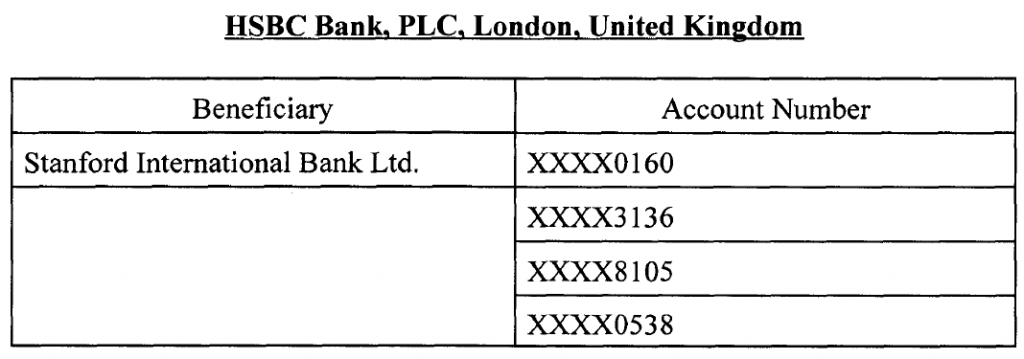

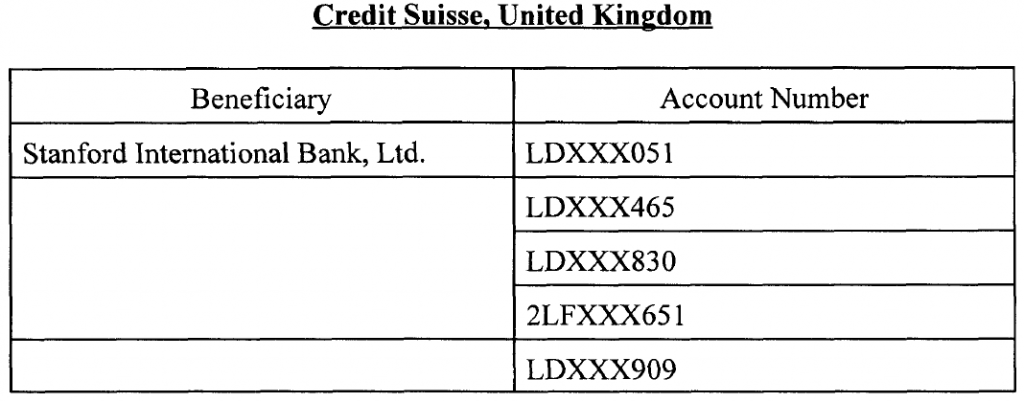

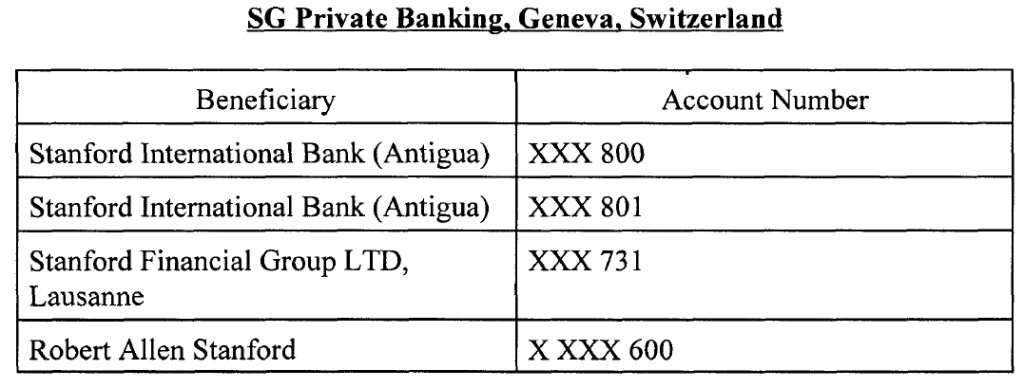

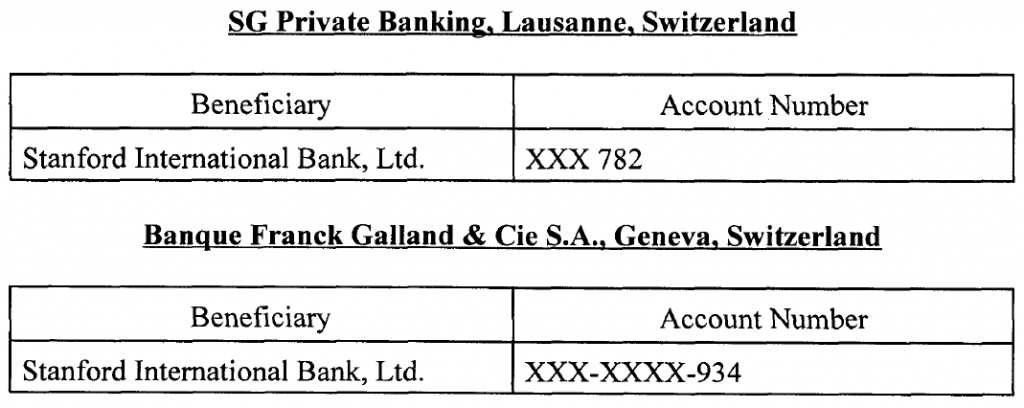

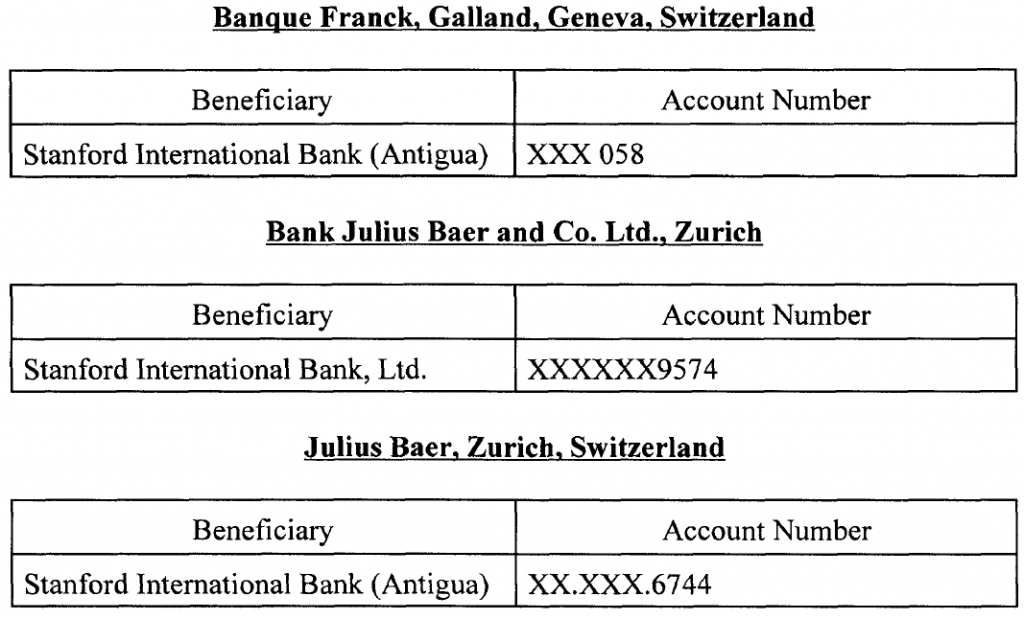

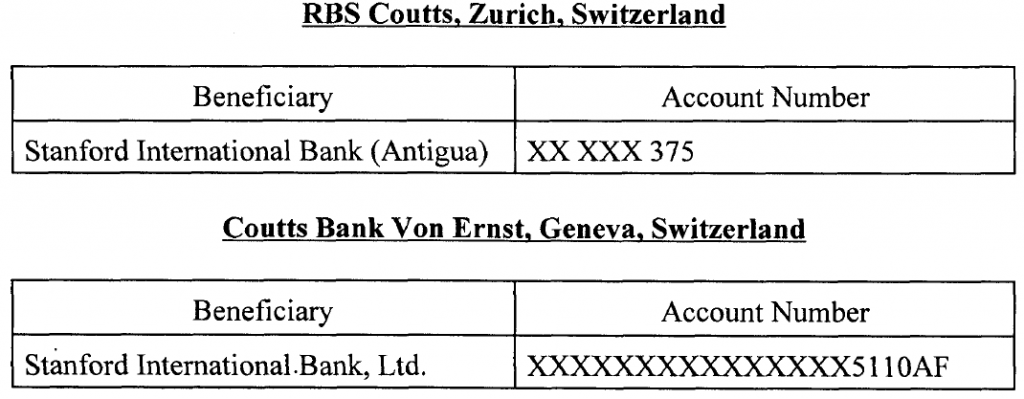

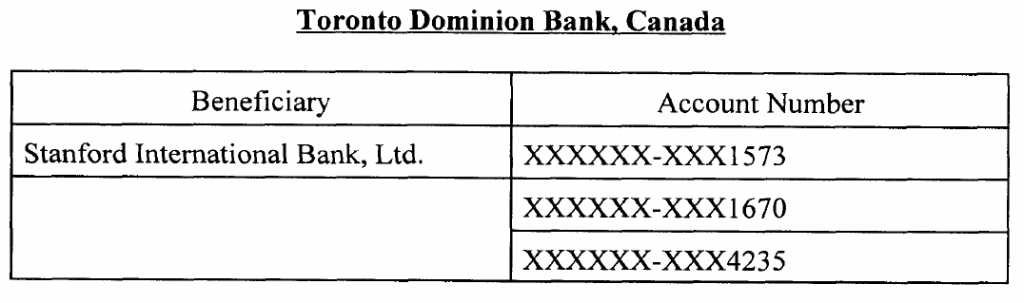

3. It was a part of the conspiracy that STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others would cause the movement of millions of dollars of fraudulently obtained investors’ funds from and among bank accounts located in the Southern District of Texas and elsewhere in the United States to various bank accounts located outside of the United States, including as follows:

a. STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others would cause investors and potential investors in SIBL’s products to transfer the investors’ funds into bank accounts located in the Southern District of Texas which were maintained by STANFORD;

b. STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others would subsequently cause the transfer of the investors’ funds in amounts exceeding $10,000 from bank accounts located in the Southern District of Texas into intermediary bank accounts located outside of the United States; and

c. STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others, would cause the transfer of investors’ funds from intermediary bank accounts into other bank accounts located outside of the United States in order for STANFORD,

HOLT and DAVIS to exercise exclusive control over the investors’ funds.4. It was further a part of the conspiracy that STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others would cause the movement of millions of dollars of fraudulently obtained investors’ funds from and among bank accounts outside the United States to various bank account in the United States, in the Southern District of Texas and elsewhere, as follows:

a. STANFORD, HOLT, KUHRT, LOPEZ, DAVIS and others would cause the transfer of funds from bank accounts outside the United States to bank accounts in the United States in order to repay investors who had requested redemption of their SIBL CDs and to perpetuate the false appearance that SIBL was financially sound and was operating in accordance with the representations it had made to investors; and

b. STANFORD would make thousands of dollars of corrupt payments to KING outside the United States and KING, in turn, would transport the funds into the United States and deposit them into bank accounts at financial institutions in the United States. All in violation of Title 18, United States Code, Section 1956(h).

…