CRS Report

CRS Report

- James K. Jackson, Specialist in International Trade and Finance

- 18 pages

- March 11, 2010

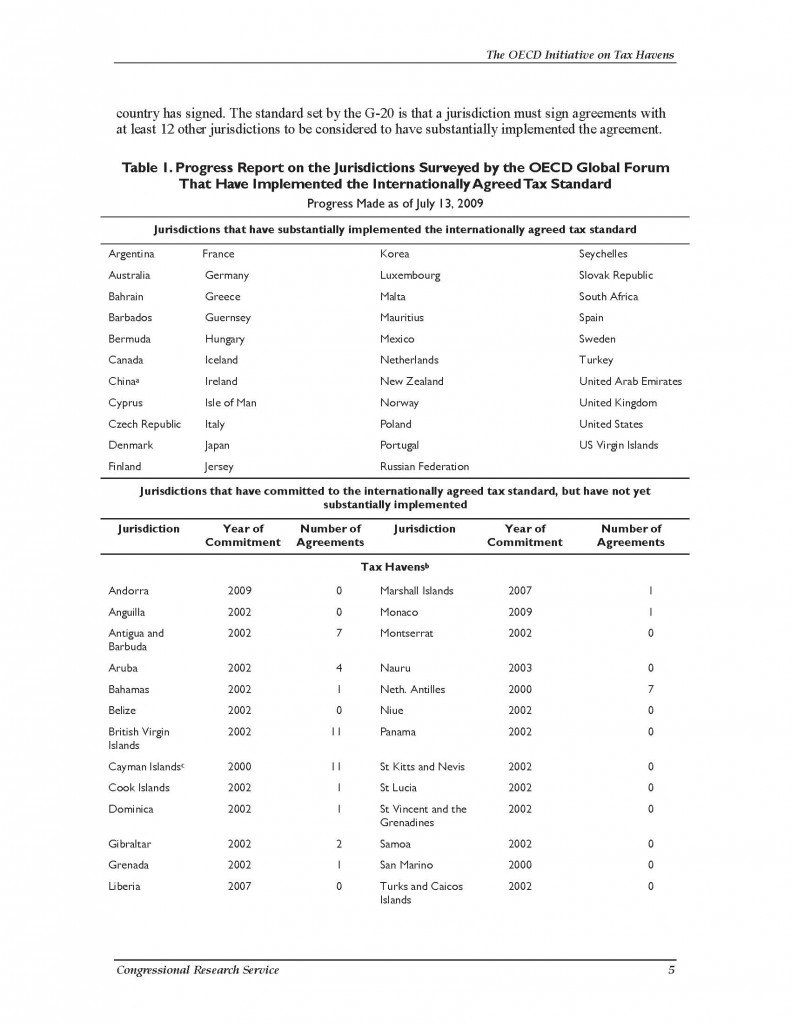

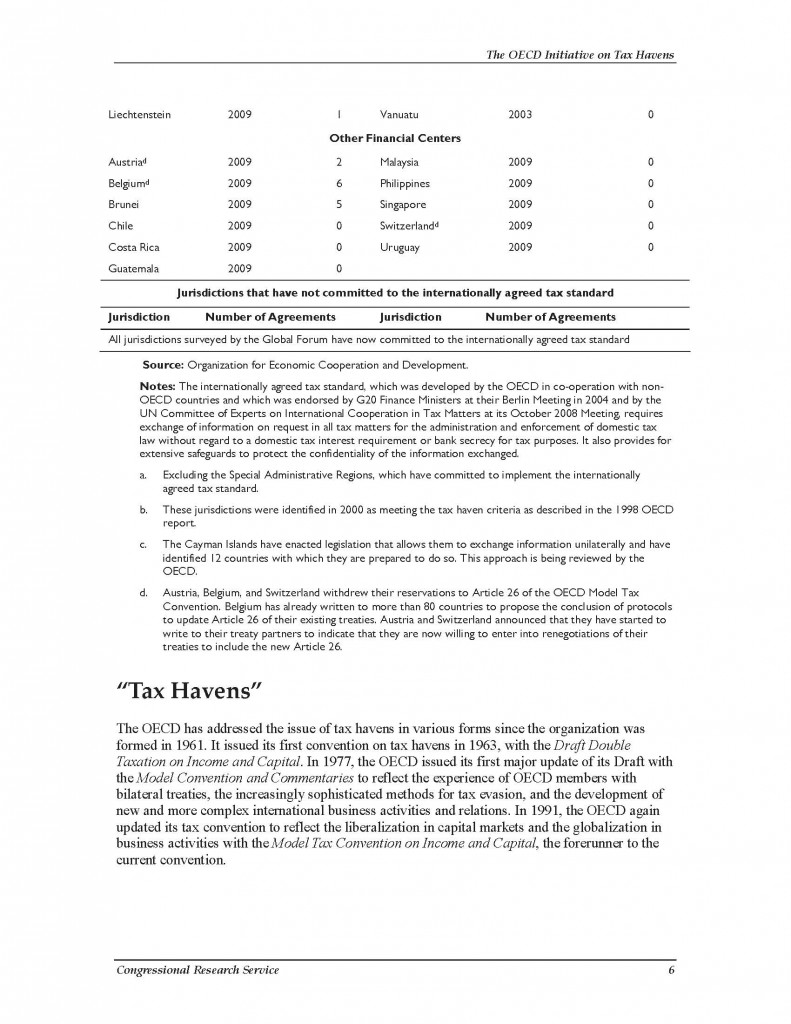

Since the 1990s, the Organization for Economic Cooperation and Development (OECD) has pursued the issues of bribery and tax havens, resulting in changes to certain U.S. laws. In addition, the OECD, under the direction of its member countries, spearheaded an international agreement to outlaw crimes of bribery, and it continues to coordinate efforts aimed at reducing the occurrence of money laundering, corruption, and tax havens. Also, the OECD is a pivotal player in promoting corporate codes of conduct that attempt to develop a set of standards for multinational firms that can be applied across national borders. On May 4, 2009, President Obama outlined his Administration’s policy to “crack down on illegal tax evasion” and to close loopholes. In the 111th Congress, companion legislation was introduced in the House (H.R. 1265) and the Senate (S. 506) to restrict the use of tax havens. Some estimates indicate that tax havens cost the United States $100 billion each year in lost tax revenues (The Christian Science Monitor, Tax Havens in U.S. Cross Hairs, by David R. Francis, June 9, 2008).

…

Two high-profile cases focused attention on the use of tax havens. The first case involved an

investigation in 2008 in Germany involving 600-700 German citizens reportedly funneling funds

into banks in Liechtenstein, taking advantage of Liechtenstein-based trusts to evade paying taxes

in Germany. At that time, Andorra, the Principality of Liechtenstein, and the Principality of

Monaco were the last remaining jurisdictions listed by the OECD as uncooperative tax havens. In

May 2009, however, the OECD’s Committee on Fiscal Affairs removed all three jurisdictions

from the list as a result of commitments they each made to implement the OECD standards of

transparency and effective exchange of information and the timetable they each set for

implementation.The second case involves the Union Bank of Switzerland (UBS). For more than a year, the IRS

had pressured the Swiss banking firm to release the names of 52,000 Americans the agency

believes have offshore accounts in Switzerland and are using Switzerland’s banking secrecy laws

to avoid paying taxes. So far, UBS has agreed to pay $780 million in fines and has admitted that it

set up shell companies and accounts in Switzerland on behalf of U.S. citizens, that it advised U.S.

citizens on the best way to hide their assets from the IRS, and that UBS employees gave U.S.

clients tips on placing pricey art and jewelry in safety deposit boxes without declaring them to the

IRS.…