Draft Presentation

Draft Presentation

- Strictly Confidential

- February 26, 2009

What is Systemic Risk?

- Systemic risk is the risk imposed by inter-linkages and interdependencies in a system or market, which could potentially bankrupt or bring down the entire system or market if one player is eliminated, or a cluster of failures occurs at once.[

- Systemic financial risk occurs when contingency plans that are developed individually to address selected risks are collectively incompatible. It is the quintessential “knee bone is connected to the thigh bone…” where every element that once appeared independent is connected with every other element.

- AIG’s business model – a sprawl of $1 trillion of insurance and financial services businesses, whose AAA credit was used to backstop a $2 trillion dollar financial products trading business – has many inherent risks that are correlated with one another. As the global economy has experienced multi-sector failures, AIG’s vast business has been weakened by these multi-sector failures.

- AIG’s original problem – an over-reliance on U.S. residential mortgage-backed securities (RMBS) in its investment portfolios – has now been deepened by weakness in the commercial mortgage-backed securities market, the global real estate market, the global equities market, slowing business and consumer spending activity and the concomitant demand for higher liquidity by regulators and customers around the world.

- Systemic risk afflicts all life insurance and investment firms around the world. Thus, what happens to AIG has the potential to trigger a cascading set of further failures which cannot be stopped except by extraordinary means.

Risk Assessment Summary

- In the fall of 2008, the Federal Reserve and Department of the Treasury determined that the systemic risk of a failure of AIG was so great that they should provide a support program by injecting liquidity and equity capital into AIG.

- To repay the debt and reduce the degree of financial risk to the firm, AIG has instituted a wind-down of its Financial Products business and a massive divestiture process to sell businesses, despite the increasingly difficult M&A and credit environment.

- The previously provided solution addressed short-term liquidity needs and AIG’s overconcentration in the RMBS market. But AIG still faces massive investment losses and credit downgrades. Without additional federal tools being deployed in the AIG situation, AIG will not be able to repay its obligations. Despite adequate current security against the U.S. government’s investment, that investment may not be recovered.

- AIG operates in more than 140 countries around the world, whose customers, regulators, and governments have thus far been refrained from liquidating or seizing assets based largely on the support given to AIG by the U.S. government.

- The failure of AIG would cause turmoil in the U.S. economy and global markets, and have multiple and potentially catastrophic unforeseen consequences.

- The inability of AIG to immediately secure additional assistance from the FederalReserve and the Department of the Treasury threatens not only AIG’s sales process, but also consumer and business confidence around the world.

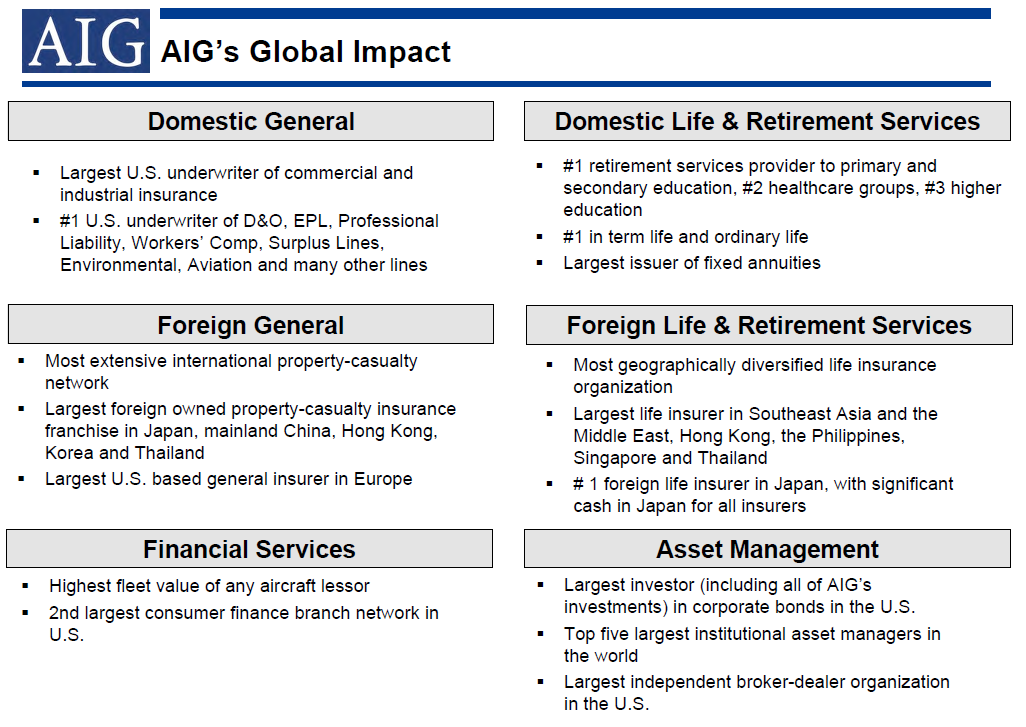

How Big is the Systemic Risk in Insurance ?

- While the term “insurance” is used, AIG and its industry brethren sell and service not just the traditional property and casualty and death benefit life insurance policies, but accident and health coverage, pension and retirement policies, and a variety of wealth accumulation vehicles, such as annuities.

- The systemic risk is principally centered in the “life insurance” business because it is this subsector that has the greatest variety of investments and obligations that are subject to loss of value of the underlying investments.

- The life insurance industry employs approximately 2.3 million people in the U.S. who sell individual and group policies. There are over $19 trillion of face value “life” policies in force in the U.S. and 375 million policies.

- Over the past decade, the voluntary termination rate on individual policies declined remarkably (to six percent by 2007) as consumers could obtain liquidity from numerous other sources.

- A significant rise in surrender rates – inspired by consumers’ needs for cash or because of rumored or real failure of insurance companies – could be disastrous. Because of widespread loss of liquidity, the industry would struggle to raise adequate cash to meet surrender requests. A “run on the bank” in the life and retirement business would have sweeping impacts across the economy in the U.S. In countries around the world with higher savings rates than the U.S., the failure of insurance companies like AIG would be a catastrophe.

Impact on U.S. Government’s Efforts to Stabilize Economy

- If AIG were to fail notwithstanding the previous substantial government support, it is likely to have a cascading impact on a number of U.S. life insurers already weakened by credit losses. State insurance guarantee funds would be quickly dissipated, leading to even greater runs on the insurance industry.

- Given AIG’s insurance companies’ relative size compared to other U.S. insurance companies, there is no ability for an “arranged marriage” of AIG’s largest units with other U.S. insurance companies.

- In addition, the government’s unwillingness to support AIG could lead to a crisis of confidence here and abroad over other large financial institutions, particularly those that have thus far remained viable because of government support programs.

- This loss of confidence is likely to be particularly acute in countries that have large investments in U.S. companies and securities and whose citizens may suffer significant losses as a result of the failure of AIG’s foreign insurance subsidiaries.

- This could lead directly to a decrease in the attractiveness of U.S. government securities and a consequent increase in borrowing costs for the U.S. government and related issuing entities.

- Moreover, permitting AIG to fail would be even more serious today than in September, especially in view of the support of the U.S. government. Public confidence in financial institutions is at a nadir and it is questionable whether the economy could tolerate another shock to the system that a failure of AIG would produce.

- The extent and interconnectedness of AIG’s business is far-reaching and encompasses customers across the globe ranging from governmental agencies, corporations and consumer to counterparties. A failure of AIG could create a chain reaction of enormous proportion.

- While some of these potential consequences are inherently judgmental and, to an extent, speculative, if there is one conclusion that can be unquestionably drawn from the failure of Lehman, it is that the adverse consequences of the failure of a major financial institution cannot be foreseen.

- Just as the government was unable to predict that the failure of Lehman would lead to the collapse of the Reserve Fund, followed by much of the money market industry, the government would be even less capable of predicting the fallout from the collapse of a much larger, more global and more consumer-oriented institution such as AIG.

…

General Impact on Economy

A failure of AIG would have a devastating impact on the U.S. and global economy.

The economic effects may include:

- Potential unemployment for a large portion of the 116,000 employees, including 50,000 employees in all 50 states and the District of Columbia (generating annual U.S. salaries totaling $3.5 billion)

- Adverse impact on AIG’s 74 million customers worldwide, including 30 million U.S. customers in its general insurance, life insurance and retirement services, and financial services businesses

- The immediate damage to credit markets worldwide from an AIG failure would dwarf the Lehman fallout. Possible outcomes for which the Treasury would need to be prepared to respond:

- Fall in the foreign exchange value of the dollar

- Increase in Treasury borrowing costs

- Doubts about the ability of the U.S. to support its banking system

…

Life Insurance Policyholders: “Run on The Bank”

- AIG has written more than 81 million life insurance policies to individuals worldwide

- Face value: $1.9 trillion

- Claims paid in 2008: more than $12 billion

- If AIG fails, policyholders are likely to seek to “cash in” policies, placing enormous strain on the insurance system, as well as bond and equity markets as assets are liquidated to pay policyholders

- Surrender of insurance policies at above-normal actuarial rates could impair current policyholders as capital, along with state guarantee funds, might be insufficient to pay all policyholder claims

- Third-party sellers of AIG products would face an unmanageable spike in customer redemption demands, damaging consumer confidence

- Forced sales of assets would be required to cover withdrawals

- Existing AIG policyholders could be unable to obtain insurance coverage from other insurance companies

- Potential dramatic increases in policy costs and/or significant decline in available products (e.g. fixed annuities)

- Some life policyholders may no longer be insurable at commensurate rates or as a result of adverse health situations since purchase of original policy

…

- AIG Commercial Insurance (AIGCI):

- Largest property casualty insurance operation in the United States

- Underwrites more than 450 insurance products and services across 83 industries

- Protects and insures approximately 180,000 entities employing over 106 million people in the U.S.

- Nearly 1/3 of all people in the United States are employed by an entity that is protected by insurance coverage through AIG Commercial Insurance

- Protects 20 million commercial and individual policyholders & certificate-holders

- Paid approximately $18.3 billion in U.S. claims in 2008

- Worldwide, AIG writes insurance for:

- 94% of the Fortune 500 – Global, with annual premiums of over $10.5 billion

- 97% of the Fortune 500, with annual premiums of nearly $9 billion

- 97% of the Fortune 1000, with annual premiums of over $10.2 billion

- 81% of the Forbes 2000, with annual premiums of nearly $15 billion

- 90% of the Financial Times 500 – Europe, with annual premiums of $6 billion

- 77% of the Financial Times 500 – U.K., with annual premiums of $2 billion