Federal Reserve Bank of Richmond

- TourRobert E. Carpenter, Lead Financial Economist, Federal Reserve Bank of Richmond, Associate Professor of Economics UMBC

- 39 pages

- Confidential

- March 31, 2009

![]()

Suspects in the subprime crisis

•Technological innovation in the delivery of credit

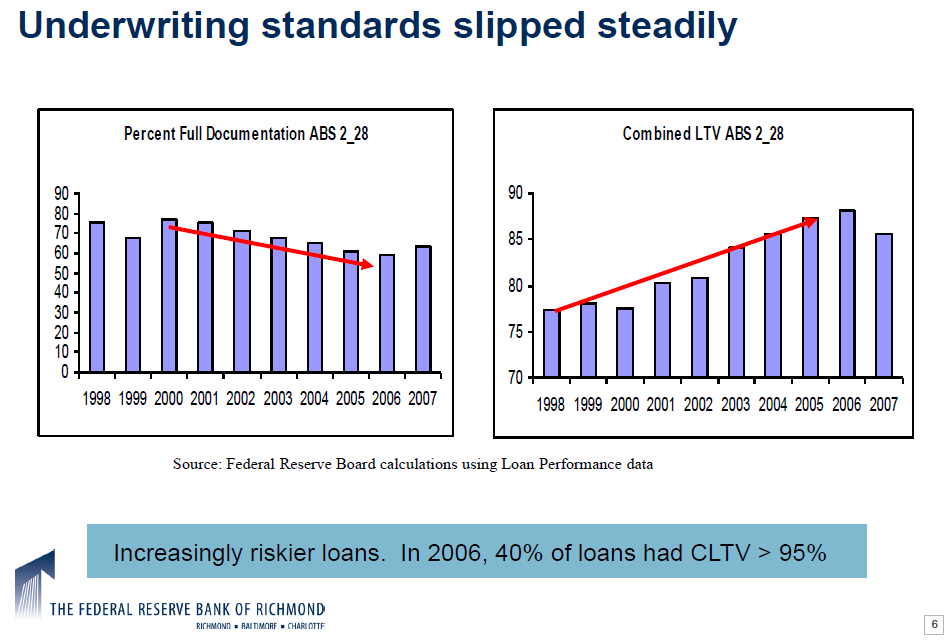

•Modeling approaches allowed lenders to more finely differentiate and pool riskier borrowers…borrowers who had trouble getting credit in the past

•Did lenders overshoot?

•High CLTV means thin equity for homeowners.

•Doesn’t take much of a decline in prices to put homeowners “under water”

•Lenders might have underestimated the probability of a broad housing shock…

Suspects in the subprime crisis

•Technological innovation in the delivery of credit

•Did lenders overshoot?

•High CLTV means thin equity for homeowners.

•Some observers pointed to a regulatory and supervisory framework “insufficiently prepared” for a big shock

•Private sector incentives to protect dampened by implicit support for Freddie and Fannie?

•Other incentive problems with off balance sheet lending?

•Official policies to increase homeownership induced some risk taking in housing finance?

•Unscrupulous and fraudulent practices of some mortgage brokers outside the banking sector?…

Suspects in the subprime crisis

•Technological innovation in the delivery of credit

•Did lenders overshoot?

•High CLTV means thin equity for homeowners.

•Some observers pointed to a regulatory and supervisory framework “insufficiently prepared” for a big shock

•Private sector incentives to protect dampened by implicit support for Freddie and Fannie?

•Other incentive problems with off balance sheet lending?

•Official policies to increase homeownership induced some risk taking in housing finance?

•Unscrupulous and fraudulent practices of some mortgage brokers outside the banking sector?…

The crisis is global

•Uncertainty in US financial markets led some institutions to retreat from providing funds to term money markets

•And on the macroeconomic side, essentially all of the big economies are now growing slowly or shrinking, plus…

•“Polish GDP Slowed Sharply in Fourth Quarter”

•“Indian Economy Slowed Sharply in Fourth Quarter”

•“Swedish Economy in Worst Slump in Decades”

•“South African GDP Slips Into Negative Territory”

•“Mexico Slides into Recession”

•“Taiwanese GDP Tanked in Fourth Quarter”

•Spreads Indicating a lack of liquidity remain elevated, although they are down from very high levels

•Very popular to show the LIBOR-OIS spread as a measure of tightness in credit markets…