Staff Report for the 2009 Article IV Consultation

Staff Report for the 2009 Article IV Consultation

- Prepared by the Western Hemisphere Department

- 41 pages

- For Official Use Only

- April 14, 2009

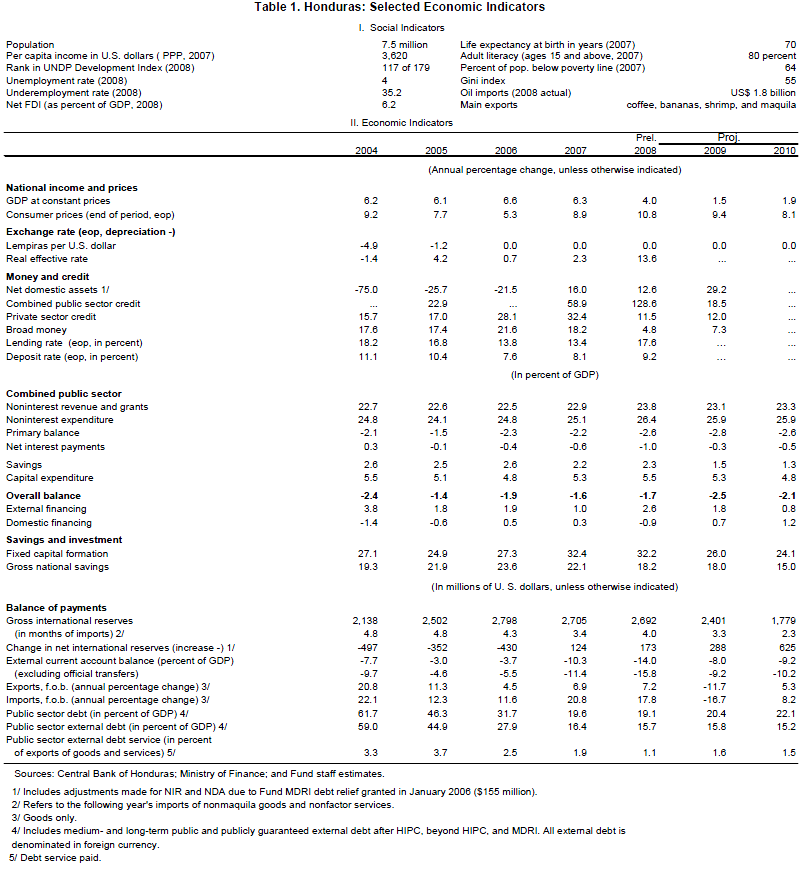

• Background. Performance since the last Article IV consultation has been mixed. Output growth has been above trend and the fiscal deficit has been low following debt relief. However, inflation has increased, the external position has weakened, and financial sector vulnerabilities are higher.

• Outlook. A large external current account deficit, combined with a sharp decline in net capital

inflows (due to global and domestic factors) could result in a balance of payments deficit of close to

US$300 million in 2009 (11 percent of gross reserves at end-2008). On current policies, reserves

could reach critically low levels by 2010–11. The growth slowdown also poses a threat to the

financial system.• Political context and authorities’ views. Presidential elections are scheduled for November 2009

and re-election is not allowed. The authorities’ priority is to support domestic demand to mitigate the

effect of the global shock on economic activity. They see maintaining the fixed exchange rate system

and loose liquidity conditions as key elements of their policy response, including because lower oil

prices have eased the need for rapid policy correction to protect the balance of payments.• Staff recommendations. With significant downside risks to the outlook, the policy priority should be

to reduce the risks of a disorderly adjustment in the balance of payments in order to preserve

macroeconomic stability and sustain growth over the medium term. The mission recommended:

- Correcting macro imbalances. By avoiding a large fiscal expansion in 2009, strengthening monetary policy, and reinstating the crawling exchange rate band.

- Increasing the resilience of the banking system. By enhancing the monitoring of liquidity, preparing contingency plans to address potential bank problems, improving compliance with provisioning norms, and continue implementing risk-based supervision.

- Building consensus with the main presidential candidates on policies for sustainable growth and poverty reduction. Reforms identified in the 2004 PRGF arrangement have not been completed and remain relevant, including strengthening governance and macroeconomic institutions.

- Fund relations. The last Article IV consultation was concluded on February 21, 2007. A 12-month Stand-By Arrangement (SBA) expired on March 30, 2009; no purchase was made and no review was completed due to large deviations in monetary and exchange rate policies.

- Mission. Discussions took place during February 23–March 5, 2009. The team comprised A. López-Mejía (Head), G. Bannister and G. Callegari (all WHD), S. Maziad (SPR) and F. Bornhorst (FAD). C. Medeiros (MCM) also joined the mission. M. Garza, the Fund’s Resident Representative assisted the mission. A. Umaña (OED) participated in the final meeting.

…

I. BACKGROUND

1. In early 2008 the Fund approved a 12-month Stand-By Arrangement with

Honduras aimed at correcting the macroeconomic imbalances identified as risks during

the 2006 Article IV consultation.1 One year ago, the economy was growing above trend,

inflation was creeping up, the external current account deficit had exceeded 10 percent of

GDP, and foreign reserves were falling (Figure 1). The SBA was to provide a bridge to an

arrangement under the Poverty Reduction and Growth Facility (PRGF) that would help

Honduras to address its structural challenges. Among these, weak institutions and

governance were seen as critical, including because of their role in the interruption of a

previous PRGF arrangement in 2006 (when substantial concessions were granted on wages

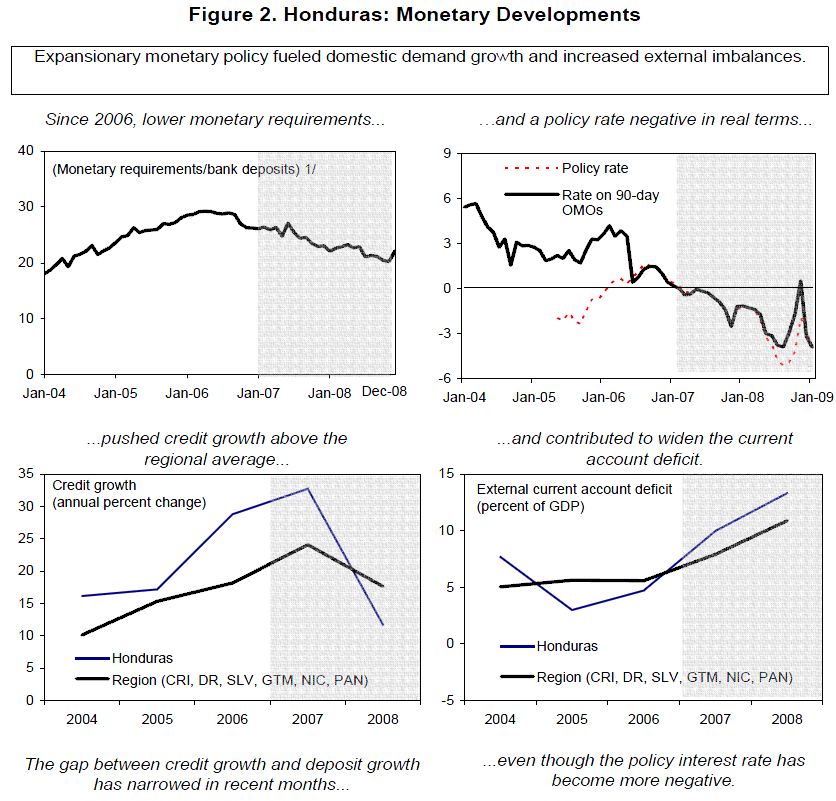

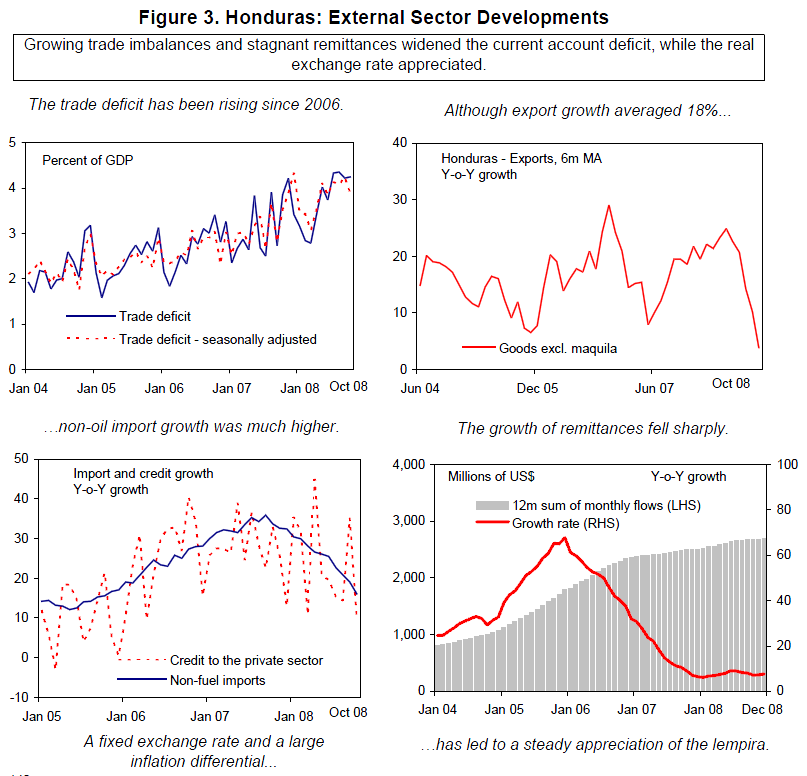

for teachers and other public sector workers).2. The main objective of the 2008 SBA was to maintain macroeconomic stability and

strengthen the foundations for sustained growth. To this end, economic policies aimed at

reorienting the fiscal stance towards priority spending, containing inflation, strengthening

the balance of payments, and addressing weaknesses in the energy sector. In the event,

external conditions (especially prices of food and oil imports) were more adverse than

envisaged and policies were not in line with those agreed under the SBA (Box 1). Despite a

rapid weakening of the balance of payments position, monetary policy remained

expansionary and the exchange rate was kept fixed (Figures 2 and 3). Fiscal performance

was mixed. The deficit target in the program (1½ percent of GDP) was missed by a small

margin (0.2 percent of GDP) as overruns in current expenditure and net lending by pension

funds (mostly to teachers) were partly offset by lower capital expenditure. While the

finances of the electricity company were strengthened, current spending (mainly untargeted

subsidies) increased as the government tried to mitigate the impact of higher oil prices on

personal income (Figure 4).

…