Consolidated Financial Statements for the Period March 14, 2008 to December 31, 2008, and Independent Auditors’ Report

- Federal Reserve Bank of New York

- Deloitte & Touche LLP

- 23 pages

- Public

- April 2, 2009

Independent Auditor’s Report

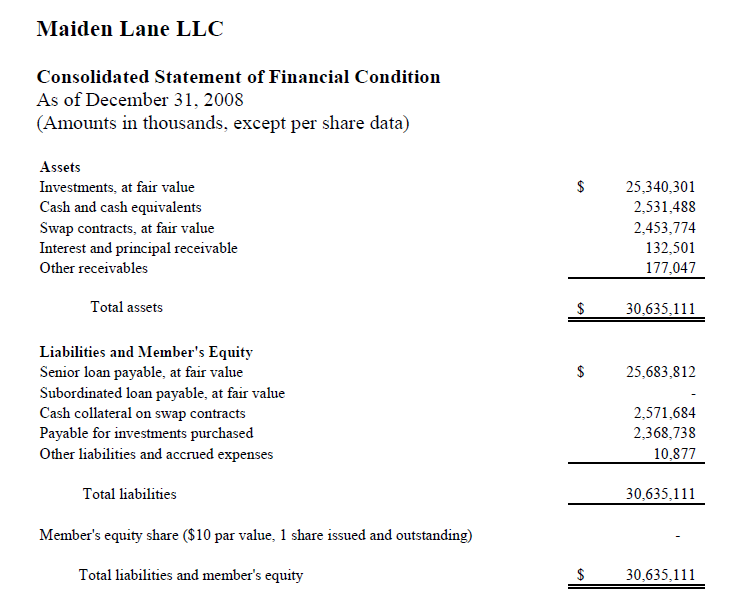

We have audited the accompanying consolidated statement of financial condition of Maiden Lane LLC (a Special Purpose Vehicle consolidated by the Federal Reserve Bank of New York) and subsidiaries (the “LLC”) as of December 31, 2008, and the related consolidated statements of income and cash flows for the period from March 14, 2008 to December 31, 2008. These financial statements are the responsibility of the LLC’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with generally accepted auditing standards as established by the Auditing Standards Board (United States) and in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free or material misstatement. The LLC is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, bur not for the purpose of expressing an opinion on the effectiveness or the LLC’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. we believe that our audit provides a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Maiden Lane LLC (a Special Purpose Vehicle consolidated by the Federal Reserve Bank of New York) and subsidiaries as of December 31, 2008, and the results of their operations and their cash flows for the period from March 14, 2008 to December 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP…

…

1. Organization and Nature of Business

In connection with and to facilitate the merger of The Bear Stearns Companies Inc. (“Bear Stearns”) and JPMorgan Chase & Co. (“JPMC”), Maiden Lane LLC, a Delaware limited liability company (a Special Purpose Vehicle consolidated by the Federal Reserve Bank of New York) (the “LLC”), was formed to acquire approximately $30 billion of Bear Stearns’ assets. The LLC is a single member limited liability company and the Federal Reserve Bank of New York (“FRBNY” or “Managing Member”) is the sole and managing member. FRBNY is the controlling party of the assets of the LLC and will remain as such as long as the FRBNY retains an economic interest. Financing for the LLC was provided by FRBNY, as the senior lender (the “Senior Loan”), and by JPMC, as the subordinated lender (the “Subordinated Loan”) (together the “Loans”). The loans are collateralized by all the assets of the LLC.

The Bear Stearns’ assets purchased by the LLC largely consisted of mortgage-related securities, whole mortgage loans (held by two grantor trusts as discussed below), a total return swap with JPMC, as well as mortgage commitments to be announced (“TBA commitments”).

Two grantor trusts were established to directly acquire the whole mortgage loan assets. One was formed to acquire the portfolio of commercial mortgage loans and one was formed to acquire the portfolio of residential mortgage loans (Maiden Lane Commercial Mortgage Backed Securities Trust 2008-I and Maiden Lane Asset Backed Securities I Trust 2008-1, together the “Grantor Trusts”). The Grantor Trusts own the whole mortgage loans. The LLC owns the trust certificates representing all of the beneficial ownership interest in each trust and as a result controls and consolidates the Grantor Trusts. The trustee and master servicers for each Grantor Trust are nationally recognized financial institutions. As master servicers to the Grantor Trusts, they are responsible for remitting to the Grantor Trusts all principal and interest payments and any other amounts collected by the primary loan servicers on the underlying loans of each respective trust. Payments received by the respective trust are passed on to the LLC as the sole beneficiary after deducting certain trust expenses, advances, servicing costs, and fees.

The assets acquired by the LLC secure the Loans made by the lenders. All assets were acquired and transferred to the LLC on June 26, 2008 with an effective valuation date of March 14, 2008. All transactions associated with the purchased assets occurring subsequent to March 14, 2008 are included in the consolidated financial statements of the LLC.

In connection with the acquisition of the assets, the LLC paid a cost of carry of $249 million to JPMC, representing a financing cost incurred from March 14, 2008 through the settlement dates on the various assets. The cost of carry is recorded as “Other interest expense” in the Consolidated Statement of Income. The transaction was completed based upon a March 14, 2008 purchase date but with settlement dates of June 26, 2008 or later. Due to the extended settlement dates, interest was charged on the cost of securities purchased or credited for cash flows on the purchased securities that occurred after March 14, 2008 through the date the securities were either paid for or received by the LLC.

The LLC does not have any employees and therefore does not bear any employee-related costs.

…

Notes to Consolidated Financial Statements For the Period March 14, 2008 to December 31, 2008

BlackRock Financial Management, Inc. (the “Investment Manager” or “BlackRock”) manages the investment portfolio of the LLC under the guidance established by the FRBNY and governed by an investment management agreement between the FRBNY and BlackRock.

…

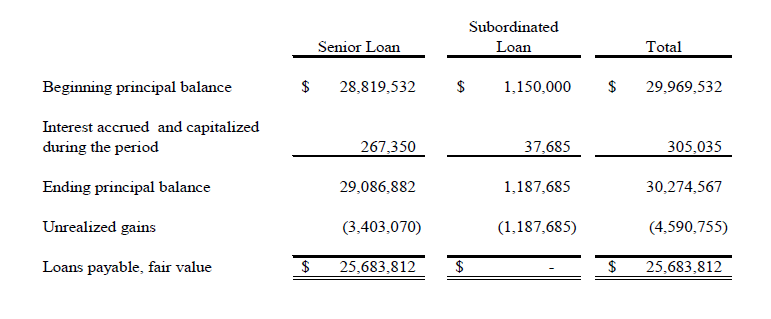

3. Loans Payable

On June 26, 2008, FRBNY extended approximately a $28.8 billion Senior Loan and JPMC extended approximately a $1.15 billion Subordinated Loan to finance the initial acquisition of the LLC’s assets. Each loan has a ten year term. FRBNY may extend the maturity date of the Senior Loan, at its sole discretion. The Senior Loan bears interest at the primary credit rate in effect and is entitled to receive additional contingent interest in amounts equal to any proceeds from the sale of the LLC assets that are available for distribution after payment in full of the principal and interest under the Loans and termination of all permitted swap agreements and payment in full of any obligations thereunder. The Subordinated Loan bears interest at the primary credit rate plus 450 basis points. The primary credit rate is the rate charged by FRBNY for loans under its discount window primary credit program. Interest on the Loans accrues daily and is compounded on the last day of the last month in each calendar quarter.

Repayment on the Senior Loan may only begin prior to the second anniversary of the closing date of the Loans if the Subordinated Loan has been paid in full. Repayment of the Loans will only occur after payment in full of closing costs for the LLC, operating expenses and maintenance of a reserve account for loan commitments.

Solely at the discretion of the FRBNY, after the second anniversary of the closing date of the Loans, FRBNY may receive first, repayment of principal, and secondly, interest on the Senior Loan, based on available funds, prior to payment of the Subordinated Loan (if outstanding) on such date; thus JPMC bears the risk of the potential loss up to the Subordinated Loan principal amount plus accrued interest. Risk in excess of the Subordinated Loan is borne by FRBNY and any gain beyond repayment of the Loans with interest will be paid to FRBNY.

As of December 31, 2008, assuming the Loans payable were immediately due and payable, the losses incurred by the LLC would have been allocated in accordance with the provisions of the applicable agreements, as follows (in thousands):

E. Other Investments

The LLC invests in CDOs. A CDO is a security issued by a bankruptcy remote entity that is backed by a diversified pool of debt securities. The cash flows of CDOs can be split into multiple segments, called “tranches”, which will vary in risk profile and yield. The junior tranches will bear the initial risk of loss followed by the more senior tranches. Because they are shielded from defaults by the subordinated tranches, senior tranches will typically have higher credit ratings and lower yields than their underlying securities, and will often receive investment grade ratings from one or more of the nationally recognized rating agencies. Despite the protection afforded by the subordinated tranches, senior tranches can experience substantial losses from actual defaults on

the underlying pool of assets.The LLC enters into dollar rolls in order to take advantage of anticipated changes in interest rates. The LLC may sell mortgage-backed securities for delivery in the current month and simultaneously contract to repurchase substantially similar (same type, coupon and maturity) securities on a specific future date at an agreed-upon price. The market value of the securities that the LLC is

required to purchase may decline below the agreed upon repurchase price of those securities. Pools of mortgages collateralizing the purchased securities may have different prepayment histories than those sold. During the period between the sale and the repurchase, the LLC will not be entitled to receive interest and principal payments on the securities sold. Proceeds of the sale will be invested in additional instruments for the LLC, and the income from these investments will generate income for the LLC. If such income does not exceed the income, capital appreciation and gain or loss that would have been realized on the securities sold as part of the dollar roll, the use of this technique will lower the investment performance of the LLC compared with what the performance would have been without the use of dollar rolls.…

7. Other

During the period ended December 31, 2008, the LLC invested available cash in the BlackRock Liquidity Funds TempFund (“TempFund”), a money market fund registered under the Investment Company Act of 1940. TempFund is managed by BlackRock Institutional Management Corporation, an affiliate of the Investment Manager. The Investment Manager has agreed to waive any fees or expenses that would otherwise be allocated to the LLC by virtue of the LLC being a fund investor. The amount of such fees and expenses is deducted from investment advisory fees paid to the Investment Manager. At December 31, 2008, the LLC had approximately $2 billion invested in the TempFund.