Report on the Observance of Standards and Codes (ROSC) Fiscal Transparency Module

- Approved by Marek Belka and Sanjeev Gupta

- 56 pages

- For Official Use Only

- June 25, 2009

I. INTRODUCTION

1. This report provides an assessment of the fiscal transparency practices of Switzerland against the requirements of the IMF Code of Good Practices on Fiscal Transparency (2007). The first part is a description of practices, prepared by IMF staff on the basis of discussions with the authorities and their responses to the fiscal transparency questionnaire, and drawing on other available information. The second part is an IMF staff commentary on fiscal transparency in Switzerland. The two appendices summarize the staff’s assessments, comment on the observance of good practices, and document the public availability of information.

2. This assessment focuses primarily on fiscal transparency at the central

government (confederation) level. Given the unique character of political economy and

fiscal federalism in Switzerland, and that less than a third of general government expenditure

or revenue is accounted for by the confederation, this does not give a complete picture.

Cantons are responsible for important areas of economic and social policy, and have a strong

influence on the composition and impact of public spending, and the overall stance of fiscal

policy. Further work would be needed to prepare a comprehensive assessment of fiscal

transparency and fiscal risk covering the whole of general government.II. DETAILED DESCRIPTION OF PRACTICE

A. Clarity of Roles and Responsibilities

Definition of government activities

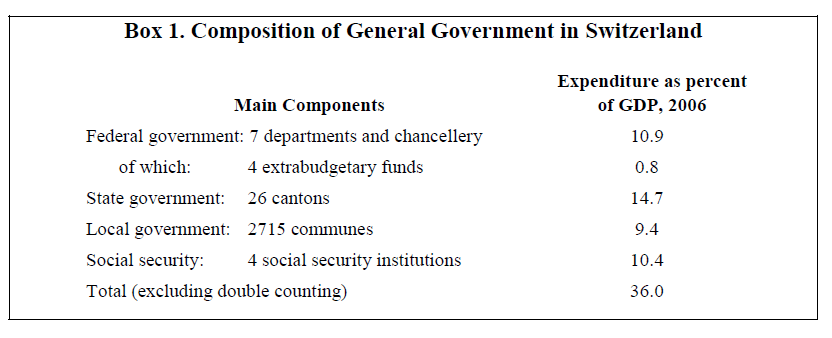

3. General government is defined consistently with Government Finance Statistics

(GFS) principles and is well covered in the budget process. 1.1.1

General government is defined in accordance with the principles of the Government Finance

Statistics Manual (GFSM 2001) and comprises four main sectors (Box 1): The federal

government comprises seven departments and related offices, the federal chancellery, and

four special funds. The special funds cover (i) railway projects; (ii) infrastructure;

(iii) technical universities; and (iv) the alcohol board. There are 26 cantonal governments.

The cantons are sovereign states with considerable autonomy. There are 2715 communes,

which likewise have considerable autonomy. The four social security institutions cover

(i) old age and survivors protection schemes; (ii) the disability protection scheme;

(iii) income compensation allowances in case of mandatory service and maternity; and

(iv) unemployment insurance. These schemes operate essentially on a pay-as-you-go basis.…

Box 2. The SNB’s Support for UBS as a Quasi-Fiscal Activity

The SNB has justified its recent support of UBS in relation to its role as lender-of-the-last resort. This explanation rests on three considerations, namely: that UBS is a systemically important institution; could provide sufficient collateral; and was solvent. On the last point, the SNB obtained advice from the Federal Banking Commission that UBS was solvent, enabling it to provide emergency support. It did so by funding 90 percent of the purchase price of distressed assets to the value of US$60 billion.1 These assets were valued by external assessors, and transferred to a Special Purpose Vehicle (SPV) under the SNB’s control. To reduce the risks of not fully recovering the funds of the SPV, the SNB has set up several safeguards against potential losses. UBS’ equity contribution to the stabilization fund, amounting to 10 percent of the assets purchased, serves as the primary loss protection. In the case of a loss on the SNB loan, the SNB’s warrant for 100 million UBS shares serves as secondary loss protection. This transaction should be classified as a QFA given the risk that the SNB may fail to recover all of its investment. In this case, the profits of the SNB distributed to the federal government would be lower, with a negative impact on the budget.

________________________

1/ On February 10, 2009, it was announced that the stabilization fund would acquire UBS assets for a lower

maximum amount than originally planned (approximately US$ 40 billion).…

68. There are some areas, however, where the authorities could consider taking

further measures, in consultation with parliament where appropriate, to enhance fiscal

transparency and the presentation and management of fiscal risks. These are summarized

below.Disclosure of additional fiscal information by the federal government

69. Support provided by the federal government and the SNB to UBS and other

financial institutions affected by the global crisis is reported in, respectively, the

confederation’s and the SNB’s financial statements, supplemented by quarterly updates

by the SNB. However, in order to provide a comprehensive assessment, the federal

government should consider publishing in its financial statements information on the SNB’s

support operations alongside the report of its own activities.70. The government should publish its findings on tax expenditures and regularly

update them. Tax expenditures do not need to be appropriated each year, thereby escaping

scrutiny and the need to compete with other fiscal priorities in the budget process. Over time,

tax expenditures can result in insidious erosion of the tax base. The volume of tax

expenditures is significant, as a recent study by the FTA indicates. The government is aware

of the importance of keeping tax expenditures in check. It could consider publishing an

annual tax expenditure statement with the annual budget.3671. The government should make an effort to disclose information on specific fiscal

risks, including contingent liabilities and QFAs, with the budget, in line with the IMF’s

Guidelines for Fiscal Risk Disclosure and Management, and eventually publish a single

statement of fiscal risks.37 In particular, the universal services provided by Swiss Post, Swiss

Rail, and others are partly financed through cross-subsidies, which represent a form of

interpersonal redistribution, and taxes and transfer payments from the budget are considered

more desirable to support such activities from a transparency perspective. QFAs are

disclosed only to a very limited extent.72. The Social Security Funds should be clearly distinguished. Apart from the

unemployment insurance scheme, the other three funds are jointly operated. The old age and

disability pension funds are cross-financing each other, with the first fund running persistent

surpluses that are used to finance the deficits of the second. Clearly, separating the three

funds would make the financial health of each of them more transparent and facilitate the

necessary policy discussion about the sustainability of current policies. Parliament has

already passed a bill to separate the old-age and disability pension funds into two separate

funds. A referendum on the issue will be held in September 2009. In addition, an overview of

the finances of the social security sector and its relationship with the budget in the short to

medium term, in the context of an assessment of long-term fiscal sustainability, should be

included in the budget documents. More forward-looking information on the finances of the special funds would also be useful. Together, these measures would provide a better basis for

assessing the sustainability of current fiscal policy.73. More information should be published on the sensitivity of the budget to changes

in macroeconomic variables and an alternative macroeconomic and fiscal scenario,

building on the useful analysis already published by the government. This would provide

a better basis for assessing the uncertainties surrounding the budget.38 In addition, the federal

government could consider extending and formalizing the process of external review of

macroeconomic forecasts and assessments of economic developments.74. An overview of the finances of public corporations could also be provided in the

budget. Some corporations receive significant funding from the budget, and others conduct

QFAs, making it important to consider their financial position and profitability in the context

of fiscal policy.75. Additional information should be reported on public debt management, namely,

the debt management strategy and performance against it, and the impact of parameter

changes on debt-servicing costs.76. A summary statement of all new policy measures that are reflected in the budget

proposals, with an estimate of their fiscal impact, should be published, to supplement the

summary data on expenditure by tasks already provided in Volume 3 of the budget

documents.77. Each federal government department should be encouraged to publish an

annual report that summarizes relevant information concerning their goals and objectives,

strategic priorities, operational risks, financial results, and nonfinancial performance. This

would be in line with practice in many OECD countries.