Rothschild Bank AG Zurich

- 64 pages

- July 31, 2009

Chairman’s Statement

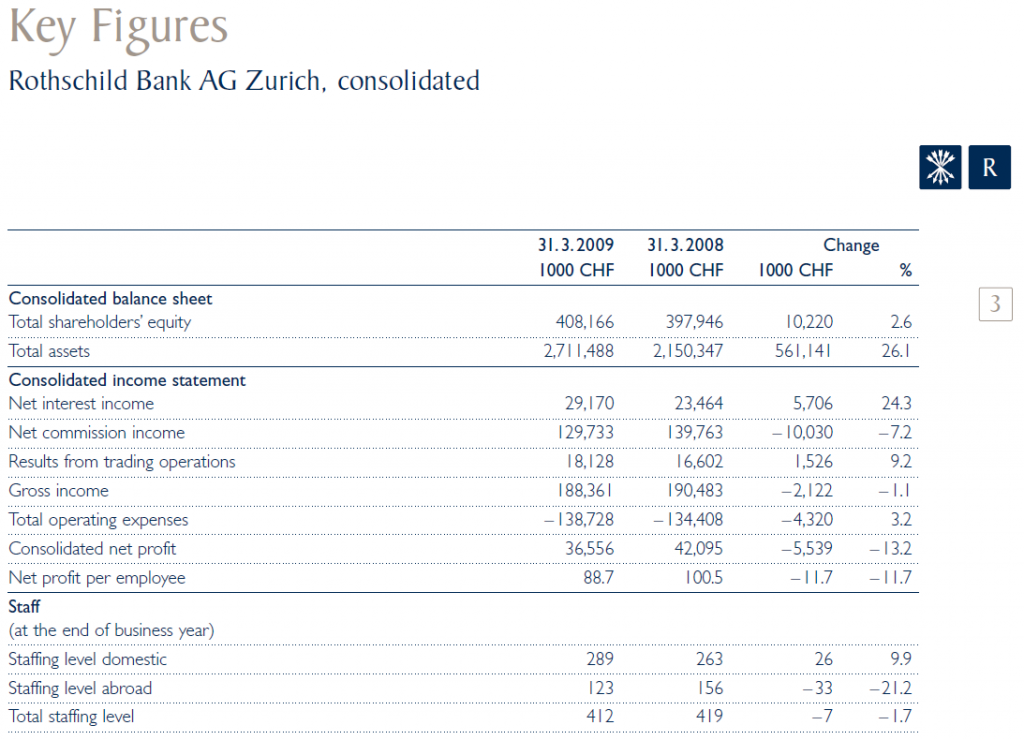

The past financial year has been one of successful development for Rothschild Bank AG, particularly when viewed against a backdrop of market turmoil.

Our prudent management, strong capital base and conservative risk policy have ensured that we have not suffered unduly in the financial crisis. On the contrary, we have been a safe harbour for our clients and an attractive destination for those families seeking a new partner to help structure and manage their wealth. Our ongoing stability, commitment to providing objective advice and the dedication of our client directors have continued to attract new clients. Our generally cautious asset allocation has proved to be the right strategy in a volatile market environment and we have avoided the speculative or risky activities that have caused problems at other banks.

During the year, we were pleased to introduce the Rothschild Group’s merchant banking initiative to our clients. This initiative is built on the Rothschild family’s track record of successful principal investing. The launch proved very popular, and many of our clients welcomed the opportunity to invest in a private equity initiative alongside the Rothschild family and senior management.

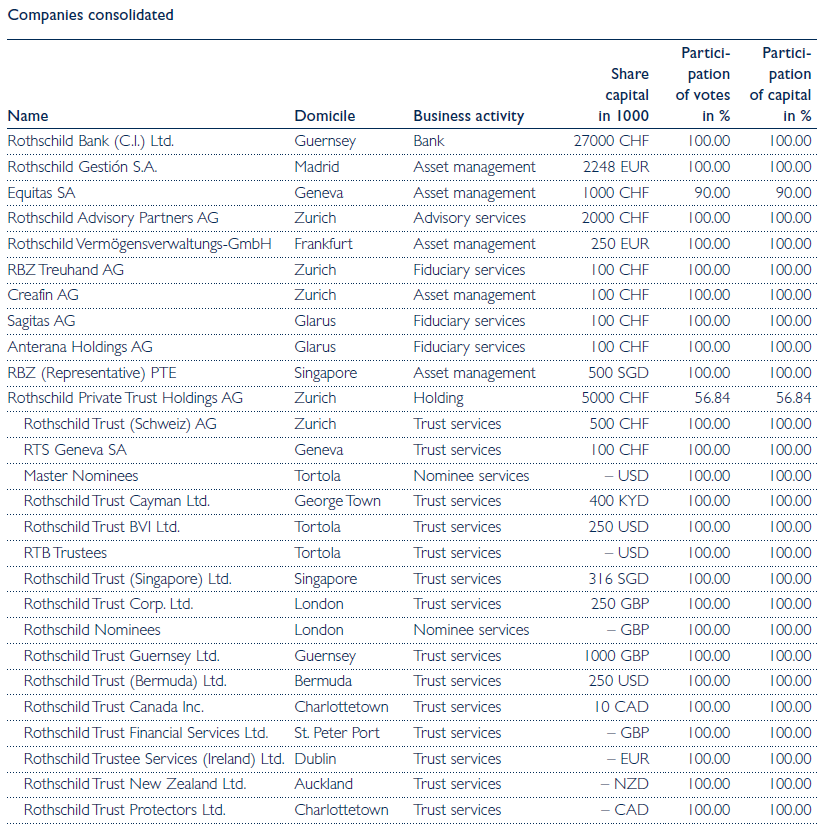

At an operational level, we have renewed our focus on our core private banking markets in Switzerland, the UK and Germany while taking the decision to close our Spanish office. In both Switzerland and the UK, we have hired new teams of private bankers. We have also hired extensively in our Trust business in response to strong demand for our international wealth structuring services. In particular, we have enhanced our Trust presence in Switzerland and Singapore while closing our Trust office in Bermuda following a global review of operational centres.

Despite the very difficult environment and significant financial investments in people, systems and infrastructure during the year, we have generated a gross annual profit of CHF 49.6 million. This compares with an equivalent figure from the previous year of CHF 56.1 million.

Our net new assets were strong at CHF 1.2 billion and our gross assets under management remained stable at more than CHF 15 billion, including custody. This is a very respectable performance in a difficult market environment, particularly given adverse currency movements such as the sharp fall of sterling against the Swiss franc.

Against that backdrop, the Board of Directors of Rothschild Bank AG has proposed to leave the size of the dividend payment unchanged at CHF 22 million. This proposed payment reflects the strong commitment of the shareholders to the development of private banking as a core activity at the heart of the Rothschild Group, balancing our other banking activities.

I would like to take this opportunity to thank Prof. Dr. Edoardo Anderheggen and Mr. Gottlieb Knoch who have retired from the Board of Directors after more than a decade of valuable service. I would also like to welcome to the Board of Directors Mr. Philip Marcovici and to announce that Dr. Hans Heinrich Coninx is being put forward for election to the Board at this year’s Annual General Meeting. Both have a wide range of skills and experience that will be of great value to Rothschild.

On behalf of my fellow Directors, I would like to express my gratitude to our clients for their continued confidence and loyalty.

Last but not least, our most sincere thanks go to our staff for their continued dedication and professionalism in what has been a very challenging year.

On behalf of the Board of Directors

Baron Eric de Rothschild

…