Office of the Special Inspector General for the Troubled Asset Relief Program

- Department of the Treasury

- 262 pages

- July 21, 2009

TARP IN CONTEXT: OTHER GOVERNMENT PROGRAMS TO ASSIST THE FINANCIAL SECTOR

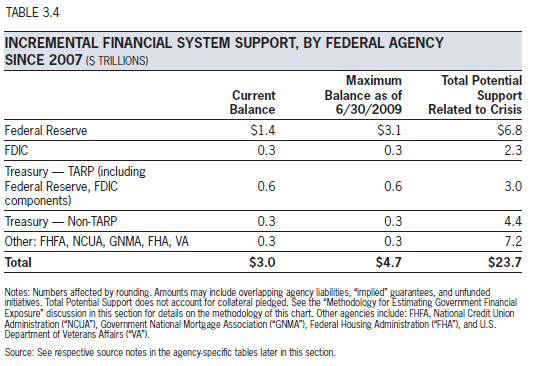

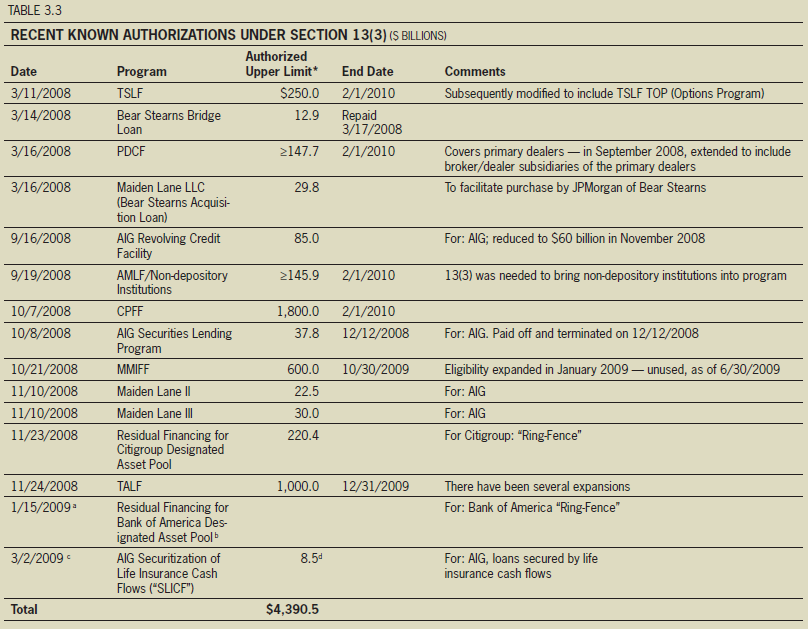

By itself, the Troubled Asset Relief Program (“TARP”) is a huge program at $700 billion. As discussed in SIGTARP’s April Quarterly Report, the total financial exposure of TARP and TARP-related programs may reach approximately $3 trillion. Although large in its own right, TARP is only a part of the combined efforts of the Federal Government to address the financial crisis. Approximately 50 initiatives or programs have been created by various Federal agencies since 2007 to provide potential support totaling more than $23.7 trillion. The Federal Reserve has been one of the lead agencies responding to the financial crisis — increasing its balance sheet to more than $2 trillion to implement a wide range of programs designed to stimulate liquidity in financial markets, as well as several institution-specific interventions. The Federal Reserve’s $2 trillion balance sheet (which grew from approximately $900 billion prior to the financial crisis to a peak of nearly $2.3 trillion in December 2008),322 however, does not reflect the true potential amount of support the Federal Reserve has provided to those programs, which is estimated to be at least $6.8 trillion. This is because many of the programs involve guarantees that, although not listed on the balance sheet, expose the Federal Reserve to significant losses if the assets they are backing deteriorate in value.

Other players in the Government’s efforts include the Federal Deposit Insurance Corporation (“FDIC”), which has contributed more than $2 trillion in new gross potential support. The newly created Federal Housing Finance Agency (“FHFA”) — under whose auspices fall the Government-Sponsored Enterprises (“GSEs”) such as Fannie Mae, Freddie Mac, and Federal Home Loan Banks

(“FHLBs”) — has effectively provided more than $6 trillion in gross potential support. Meanwhile, Treasury itself has programs outside of those authorized under the Emergency Economic Stabilization Act (“EESA”), and has supplied potential support beyond TARP of approximately $4.4 trillion. An overview of the Government’s new potential support relating to the fi nancial crisis is listed by Federal agency in Table 3.4.Of this $23.7 trillion in assistance to fi nancial institutions, participants in non-TARP programs are not subject to TARP’s restrictions and conditions, such as executive compensation, nor do they necessarily require specifi c Congressional approval. Although SIGTARP’s oversight responsibility is for the operations of TARP and directly related programs (such as TALF and the Public-Private Investment Program (“PPIP”)), it is necessary to understand the larger context in which TARP operates, the linkages between TARP and the trillions of dollars of other Government initiatives. As noted earlier, SIGTARP has no authority over any of the non-TARP activities of the agencies discussed below.

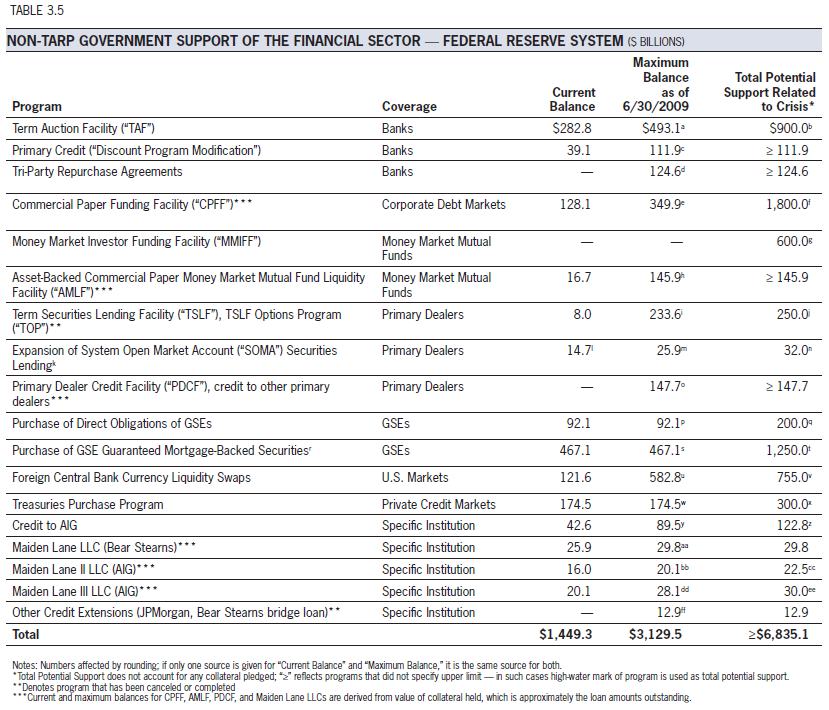

Term Auction Facility (“TAF”) — Total Potential Support: Approximately $900 Billion

The Term Auction Facility (“TAF”) allows banks to borrow funds simply by putting up collateral. It is an alternative to the Federal Reserve’s discount window, which is the means by which banks have historically raised funds in an emergency. Because of its association with emergencies, borrowing at the discount window in the past has carried a certain stigma. TAF, by contrast, is an ordinary lending program, and its use is perceived less as a sign of weakness.

TAF was created in December 2007 by the Federal Reserve Board of Governors to meet the short-term liquidity needs of banks. The Federal Reserve claimed that “by increasing the access of depository institutions to funding, the TAF has supported the ability of such institutions to meet the credit needs of their customers.” Technically, the funds are borrowed by banks in an auction that sets the interest rate. The bank must be in “generally sound fi nancial condition,” and it must post collateral — such as high-quality notes — that are subject to certain haircuts. Thus, a bank may borrow, for example, $0.92 after posting $1.00 worth of securities. The minimum interest rate a bank may bid is the interest rate paid by the Federal Reserve on excess reserve balances. Typically, the Federal Reserve conducts regular auctions of 28- and 84-day funds for $150 billion at a time.324 Banks may not necessarily have been using the funds they have borrowed from TAF to make new loans to consumers. According to the Federal Reserve’s weekly statistical releases (Table Z.1 – Flow of Funds Accounts), the banks have, in aggregate, been adding the cash to their reserves at the Federal Reserve. See Figure 3.3 for a comparison of bank borrowings from the Federal Reserve (which are predominantly through TAF), versus the cash that the banks have placed as reserves at the Federal Reserve.

Primary Credit Program (the “Discount Program Modification”) — Total Potential Support: At Least $111.9 Billion

Primary credit loans are taken by banks at the Federal Reserve’s discount window when they require short-term funds to meet the needs of their customers and creditors. Normally, the Federal Reserve lends at a fi xed rate and the bank must post suitable collateral, subject to a haircut. In August 2007, the Federal Reserve set the term at 30 days and approved a 50-basis-point reduction in the primary credit rate to narrow the spread to 50 basis points, or 0.5%, in response to the liquidity crisis in the banking system. Accessibility was broadened in March 2008, as the interest rate was lowered to 25 basis points over the FOMC target federal funds rate, and the term has been lengthened from 30 to 90 days, renewable by the borrower. Tri-Party Repurchase

Agreements (“Repo’s”) — Total Potential Support: At Least $124.6 Billion

According to the Federal Reserve, “repurchase agreements reflect some of the Federal Reserve’s temporary OMOs. Repurchase agreements are transactions in which securities are purchased from a primary dealer under an agreement to sell them back to the dealer on a specified date in the future. The difference between the purchase price and the repurchase price reflects an interest payment. The Federal Reserve may enter into repurchase agreements for up to 65 business days, but the typical maturity is between one and 14 days. Federal Reserve repurchase agreements supply reserve balances to the banking system for the length of the agreement. The Federal Reserve employs a naming convention for these transactions based on the perspective of the primary dealers: the dealers receive cash while the Federal Reserve receives the collateral.”326 In an effort to mitigate problems in certain Repo markets, on September 14, 2008, the Federal Reserve Board announced that it would provide a “temporary exception to the limitations in section 23A of the Federal Reserve Act” (which limits a bank’s credit exposure to its affiliates). This exception “allows all insured depository institutions to provide liquidity to their affiliates for assets typically funded in the tri-party repo market.

Commercial Paper Funding Facility (“CPFF”) — Total Potential Support: $1.8 Trillion

The Commercial Paper Funding Facility (“CPFF”) was created in October 2008 to provide an emergency source of funds (in the Federal Reserve’s terms, a “liquidity backstop”)329 to U.S. corporations that borrow short-term funds by issuing Commercial Paper (“CP”). CP is a short-term debt security used by corporations to raise funds in what has historically been a liquid market. This market ceased to function well in the fall of 2008, and the CPFF has played a role in assuring issuers and investors in CP that they have a “buyer of last resort.” The CPFF, according to the Federal Reserve Board’s February 24, 2009, Monetary Report to Congress, “is intended to improve liquidity in short-term funding markets and thereby increase the availability of credit for businesses and households.”330 Under CPFF, the Federal Reserve Bank of New York (“FRBNY”) is committed to lending funds as needed to a special purpose vehicle (“SPV”) that buys eligible CP from eligible issuers. Eligible CP is U.S.-dollar-denominated CP or asset-backed CP rated at least A-1/P-1/F1 (these are the top ratings of the different rating agencies). Eligible issuers are U.S. corporations, including those with a foreign parent company. For any given issuer, the SPV is limited to the maximum amount of CP that issuer had outstanding between January 1 and August 31, 2008. Issuers must pay a fee to FRBNY of 0.1% of the maximum amount of its CP the SPV could own. The CPFF is scheduled to expire on February 1, 2010.331

Money Market Investor Funding Facility (“MMIFF”) — Total Potential Support: $600 Billion

Money market funds are large investment funds that buy high-quality, short-term debt instruments such as Treasury securities and high-quality bank and corporate notes. Investors in money market funds want absolute safety for their principal and fast access to funds. In turn, banks and other fi nancial intermediaries depend on the money market as a source of funds for their business and household customers. In 2008, this market experienced the same liquidity problems as other markets — that is, investors could not fi nd buyers for securities they were seeking to sell when needed.

To meet this liquidity need, the Federal Reserve created the Money Market Investor Funding Facility (“MMIFF”) on October 21, 2008. According to the Federal Reserve Board’s Monetary Report to Congress, “the Federal Reserve Bank of New York will provide senior secured funding to a series of SPVs to facilitate an industry-supported private-sector initiative to finance the purchase of eligible assets from eligible investors. Eligible assets include U.S. dollar-denominated certificates of deposit and commercial paper issued by highly rated fi nancial institutions and having remaining maturities of 90 days or less.” The SPVs for the MMIFF are similar to the SPV for CPFF in that they purchase eligible money market paper using funds from MMIFF and asset-backed CP. FRBNY is committed to lending the SPVs 90% of the purchase price of eligible assets; sellers of assets to the SPV will receive that much in cash and the remaining 10% in asset-backed securities from the SPV. The MMIFF has not yet funded any purchases of money market instruments. Even without having advanced funds to the market, the program may be considered by the market to be working merely by its existence; investors are given the comfort that if they need it, it is available. The MMIFF SPVs are authorized through October 30, 2009.

Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (“AMLF”) — Total Potential Support: At Least $145.9 Billion

The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (“AMLF”) is designed to assist money market funds that hold asset-backed commercial paper (“ABCP”). Through the facility, the Federal Reserve provides non-recourse loans at the primary credit rate to U.S. depository institutions and bank holding companies to fi nance their purchases of high-quality ABCP from money market mutual funds. According to the Federal Reserve, AMLF is intended “to assist money funds that hold such paper in meeting demands for redemptions by investors and to foster liquidity in the ABCP markets and broader money markets.” The AMLF was initially authorized on September 19, 2008, and although originally scheduled to terminate in January 2009, has been subsequently extended by the Federal Reserve Board to February 1, 2010.336

Term Securities Lending Facility (“TSLF”), and Term Securities Lending Facility Options Program (“TOP”) — Total Potential Support: $250 Billion

In the securities markets, primary dealers are a group of securities broker-dealers who specialize in Treasury and Federal agency debt, and who have the right to trade directly with the Federal Reserve System. They also participate directly in U.S. Treasury auctions. They are an important conduit for fi nancial interactions between the Federal Government and the private markets. In early 2008, this dealer system was under increasing liquidity pressure, which the Federal Reserve addressed on March 11, 2008, with the establishment of a Term Securities Lending Facility (“TSLF”). According to the Federal Reserve Board’s February, 2009 Monetary Report to Congress, “Under the TSLF, the Federal Reserve lends up to $200 billion of Treasury securities to primary dealers for a term of 28 days (rather than overnight, as in the regular securities lending program); the lending is secured by a pledge of other securities.” The other securities that must be posted as collateral were broadened from the traditional eligible assets — Treasury and Federal agency securities, and AAArated private-label residential mortgage-backed securities (“RMBS”) — to include all investment-grade debt securities. TSLF makes securities available in weekly auctions. The program is scheduled to end on February 1, 2010.

An extension of the TSLF is the TSLF Options Program (“TOP”), described by FRBNY as a program intended to “enhance the effectiveness of TSLF by offering added liquidity over periods of heightened collateral market pressures, such as quarter-end dates.” The program “offers options on a short-term fi xed rate of [TSLF] bond-for-bond loan of general Treasury collateral against a pledge of eligible collateral.” FRBNY’s Open Market Trading Desk will offer a total of $50 billion in options for each targeted period. As of June 25, 2009, the TOP has been suspended, although the Federal Reserve states that it is prepared to resume TOP auctions “if warranted by evolving market conditions.”

Expansion of System Open Market Account (“SOMA”) Securities Lending — Total Potential Support: $32 Billion Increase in Funding

The System Open Market Account (“SOMA”) was started in 1969, and is managed by FRBNY. The account contains dollar-denominated assets purchased in open market operations, and is a “store of liquidity in the event an emergency need for liquidity arises.” Borrowing is permitted “for the purpose of covering an expected fail to receive on the part of a dealer. In order to prevent lending activity from affecting reserves, Treasury securities, rather than cash, are posted with the Federal Reserve as collateral.” In response to market pressures, the program was expanded on September 23, 2008, to raise the current dealer aggregate limit from $3 billion to $4 billion and raised again on October 8, 2008, to $5 billion per dealer.

Primary Dealer Credit Facility (“PDCF”) — Total Potential Support: At Least $148 Billion

The Federal Reserve Board’s February 2009 Monetary Report to Congress states that “to bolster market liquidity and promote orderly market functioning, on March 16, 2008, the Federal Reserve Board voted unanimously to authorize the Federal Reserve Bank of New York to create a lending facility — the Primary Dealer Credit Facility [“PDCF”] — to improve the ability of primary dealers to provide financing to participants in securitization markets.”348 Loans are made to primary dealers, against which they must post eligible collateral — the defi nition of which has been expanded from all investment-grade securities to now include “all collateral eligible for pledge in tri-party funding arrangements through the major clearing banks. The interest rate charged on such credit is the same as the primary credit rate at the Federal Reserve Bank of New York.”349 The fi rst participants in the PDCF were Merrill Lynch, Goldman Sachs, and Morgan Stanley; it was later expanded to include other primary dealers. The program is scheduled to terminate on February 1, 2010.

Purchases of Direct Obligations of GSEs — Total Potential Support: $200 Billion

Government-Sponsored Enterprises (“GSEs”) are private corporations created by Congress to fulfill certain financial policy goals, primarily in the housing finance markets. The most prominent of these are Fannie Mae, Freddie Mac, and the FHLBs. As Fannie Mae and Freddie Mac in particular encountered difficulty raising funds in 2008, their problems affected the housing markets in general, where these two agencies alone accounted for more than half of all financing. To promote market functioning, the availability of credit, and support for the housing and mortgage markets, the Federal Reserve, on September 19, 2008, announced that it would commence purchasing debt and other instruments of the GSEs though its Open Market Trading Desk; these purchases are made in competitive auctions through primary dealers.

On November 25, 2008, the Federal Reserve announced a program to purchase up to $100 billion in the GSEs’ direct obligations. Note that GSEs raise funds for mortgage lending in two ways — by direct borrowing or by guaranteeing third-party mortgage-backed securities (“MBS”). On March 18, 2009, the Federal Reserve’s FOMC increased the size of these lines to a total of $200 billion for direct obligations. Although the direct borrowing line has been focused on fixed-rate, non-callable, senior benchmark securities of the GSEs, the Federal Reserve has stated that it may change the scope of its purchases in the future.

Purchases of GSE-Guaranteed MBS — Total Potential Support: $1.25 Trillion

In addition to purchasing the direct obligations of GSEs, the Federal Reserve is further supporting the mortgage markets by committing to purchase up to $1.25 trillion of MBS that have been guaranteed by the GSEs. This purchase line was originally announced on November 25, 2008, with a maximum purchase limit of $500 billion, but this amount was raised by $750 billion to $1.25 trillion on March 18, 2009.

Foreign Central Bank Currency Liquidity Swaps — Total Potential Support: $755 BillionOn December 12, 2007, the FOMC announced that it had authorized dollar liquidity swap lines with the European Central Bank and the Swiss National Bank in order to “provide liquidity in U.S. dollars to overseas markets.” Since then, the program has expanded to include additional central banks. The Federal Reserve describes the transactions as follows: “These swaps involve two transactions. When a foreign central bank draws on its swap line with the Federal Reserve, the foreign central bank sells a specified amount of its currency to the Federal Reserve in exchange for dollars at the prevailing market exchange rate. The Federal Reserve holds the foreign currency in an account at the foreign central bank. The dollars that the Federal Reserve provides are deposited in an account that the foreign central bank maintains at the Federal Reserve Bank of New York. At the same time, the Federal Reserve and the foreign central bank enter into a binding agreement for a second transaction that obligates the foreign central bank to buy back its currency on a specified future date at the same exchange rate. The second transaction unwinds the first. At the conclusion of the second transaction, the foreign central bank pays interest, at a market-based rate, to the Federal Reserve.

“When the foreign central bank lends the dollars it obtained by drawing on its swap line to institutions in its jurisdiction, the dollars are transferred from the foreign central bank’s account at the Federal Reserve to the account of the bank that the borrowing institution uses to clear its dollar transactions. The foreign central bank remains obligated to return the dollars to the Federal Reserve under the terms of the agreement, and the Federal Reserve is not a counterparty to the loan extended by the foreign central bank. The foreign central bank bears the credit risk associated with the loans it makes to institutions in its jurisdiction.”

Treasuries Purchase Program (“TPP”) — Total Potential Support: $300 Billion

On March 18, 2009, the FOMC announced that “to help improve conditions in private credit markets, the [FOMC] Committee decided to purchase up to $300 billion of longer-term Treasury Securities over the next six months.”355 The Federal Reserve states that the goal of TPP is “to provide support to mortgage and housing markets and to foster improved conditions in fi nancial markets more generally” by cheapening the yields of the longer-term Government securities which are the benchmarks against which the rates of long-term loans, such as mortgages, are set.

Credit to American International Group, Inc. — Total Potential Support: $122.5 BillionThe Federal Reserve Board’s Monetary Report to Congress states that “In early September, the condition of American International Group, Inc. (“AIG”), a large, complex financial institution, deteriorated rapidly. In view of the likely systemic implications and the potential for significant adverse effects on the economy of a disorderly failure of AIG, on September 16, the Federal Reserve Board, with the support of Treasury, authorized the Federal Reserve Bank of New York to lend up to $85 billion to the fi rm to assist it in meeting its obligations and to facilitate the orderly sale of some of its businesses. This facility had a 24-month term, with interest accruing on the outstanding balance at a rate of 3-month Libor plus 850 basis points, and was collateralized by all of the assets of AIG and its primary non-regulated subsidiaries. On October 8, the Federal Reserve announced an additional program under which it would lend up to $37.8 billion to fi nance investment-grade, fixed-income securities held by AIG. These securities had previously been lent by AIG’s insurance company subsidiaries to third parties.”357 This facility was repaid in full and terminated on December 12, 2008.358 Subsequently, in November 2008, “Treasury, through TARP, purchased $40 billion of newly issued AIG preferred shares under the Systemically Signifi cant Failing Institutions (“SSFI”) program. The $40 billion took some of the pressure off the first Federal Reserve line of credit, allowing the Federal Reserve to reduce from $85 billion to $60 billion the total amount available under the credit facility.”359 In addition to reducing the size of the line of credit, the Federal Reserve reduced the interest rate on the facility and extended the term of the facility from two years to fi ve years. On March 2, 2009, the Federal Reserve announced authorization for new loans of up to an aggregate amount of approximately $8.5 billion to special purpose vehicles established by domestic life insurance subsidiaries of AIG that would be repaid by the net cash fl ows from designated blocks of life insurance policies held by the parent insurance companies.

Maiden Lane LLC (Bear Stearns) — Total Potential Support: $29.8 Billion

In mid-March of 2008, Bear Stearns, a major investment bank and primary dealer, was in imminent danger of failure. According to the Federal Reserve Board’s February 2009 Monetary Report to Congress, “A bankruptcy fi ling would have forced the secured creditors and counterparties of Bear Stearns to liquidate underlying collateral, and given the illiquidity of markets, those creditors and counterparties might well have sustained substantial losses. If they had responded to losses or the unexpected illiquidity of their holdings by pulling back from providing secured financing to other firms and by dumping large volumes of illiquid assets on the market, a much broader fi nancial crisis likely would have ensued. Thus, the Federal Reserve judged that a disorderly failure of Bear Stearns would have threatened overall fi nancial stability and would most likely have had significant adverse implications for the U.S. economy.”362 To prevent a complete collapse of Bear Stearns, therefore, the Federal Reserve invoked its emergency authorities under Section 13(3) of the Federal Reserve Act to authorize a loan of $30 billion, secured by $30 billion in Bear Stearns’ assets, to be used by JPMorgan to purchase Bear Stearns and to assume the company’s financial obligations. A limited liability company, Maiden Lane LLC was formed to facilitate these arrangements, particularly to hold and manage certain assets. On June 26, 2008, JPMorgan completed the acquisition. Maiden Lane LLC purchased approximately $30 billion in Bear Stearns assets on that date with approximately $29 billion of funding from the Federal Reserve to Maiden Lane LLC and a subordinated loan of approximately $1 billion from JPMorgan. Today, the Federal Reserve is managing the disposition of Bear Stearns’ assets.

Maiden Lane II LLC and Maiden Lane III LLC (American International Group, Inc.) — Total Potential Support: $22.5 Billion and $30.0 Billion, Respectively

The Federal Reserve Board’s April 2009 Monetary Report to Congress states that “In November 2008, the Federal Reserve also announced plans to restructure its lending related to AIG by extending credit to two newly formed limited liability companies. The first, Maiden Lane II LLC, received a $22.5 billion loan from the Federal Reserve and a $1 billion subordinated loan from AIG and purchased residential mortgage-backed securities from AIG. As a result of these actions, the securities lending facility established on October 8 was subsequently repaid and terminated. The second new company, Maiden Lane III LLC, received a $30 billion loan from the Federal Reserve and a $5 billion subordinated loan from AIG and purchased multi-sector collateralized debt obligations on which AIG ha[d] written credit default swap contracts.” The Federal Reserve’s fi rst quarterly report on its credit and liquidity programs shows a decline in fair value on the assets held in the AIG-related Maiden Lane facilities — a decline in fair value of $2.5 billion and $6.4 billion, respectively, for Maiden Lanes II and III.

Bridge Loan to JPMorgan Chase & Bear Stearns — Total Potential Support: $12.9 Billion

According to the Federal Reserve, on March 14, 2008, FRBNY made an overnight discount window loan of $12.9 billion to JPMorgan to facilitate its purchase of Bear Stearns; this was done simultaneously, in a back-to-back transaction, to provide secured financing to Bear Stearns. The loan was repaid in full the following Monday, March 17, 2008, “with interest of nearly $4 million.” The Federal Reserve Board describes this decision to extend credit as “designed to provide funding to Bear Stearns to meet its immediate liquidity needs for that day and to give the company and policymakers additional time to develop a more permanent solution to the company’s severe liquidity pressures that threatened to cause its sudden default and bankruptcy.”

…

TARP ADMINISTRATIVE AND PROGRAM EXPENDITURES

Treasury stated that it had incurred $27.5 million in TARP-related administrative expenditures through June 30, 2009. Table 4.1 summarizes these expenditures, as well as additional obligations through June 30, 2009. The majority of these costs are allocated to Personnel Services and Non-Personnel Other Services.

Additionally, Treasury has released details of programmatic expenditures. These expenditures include costs to hire fi nancial agents and legal firms associated with TARP operations. Treasury shows the allocation of these programmatic costs at $64 million as of June 30, 2009.

TARP operations are projected to cost approximately $175 million for fiscal year 2009.419 These costs are not reflected in determining any gains or losses on the TARP-related transactions and are not included in the $699 billion limit on asset purchases. Therefore, these expenditures will add to the Federal budget deficit regardless of whether the TARP transactions result in a gain or a loss for the Government.

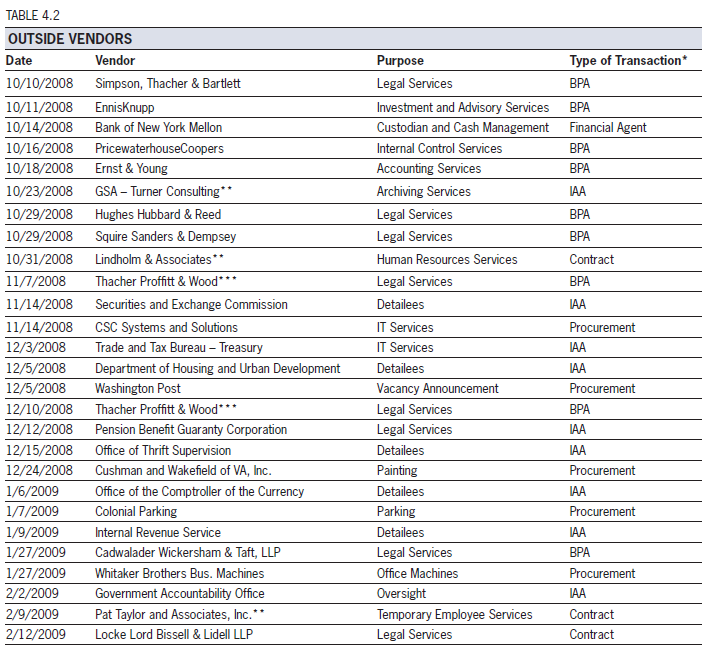

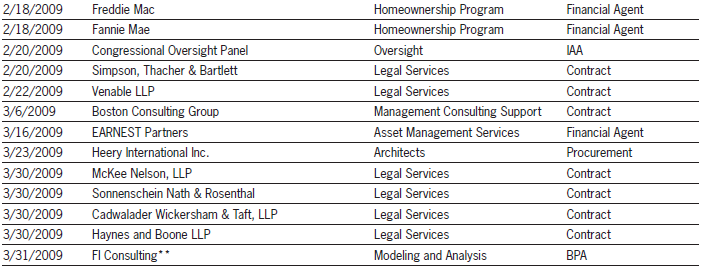

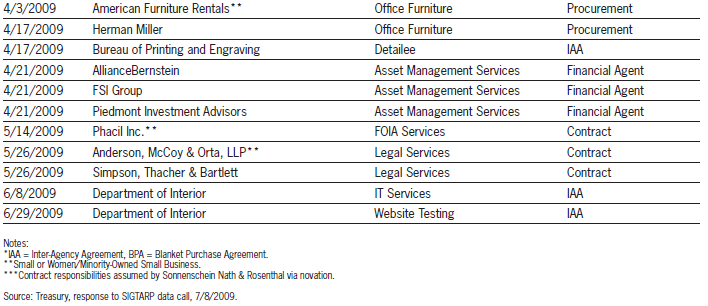

CURRENT CONTRACTORS AND FINANCIAL AGENTS

As of June 30, 2009, Treasury had retained 45 outside contractors, including 4 asset managers, to provide a range of services to assist in administering TARP. As permitted in EESA, Treasury has used streamlined solicitation procedures and has structured several agreements and contracts to allow for fl exibility in obtaining the required services expeditiously. Table 4.2 lists outside vendors as of June 30, 2009.

As required by EESA, SIGTARP must report the biographical information for each person or entity hired to manage the troubled assets associated with TARP. Since the publication of SIGTARP’s April Quarterly Report, there have been four important staff- or contractor- related developments at OFS:

- confirmation of a new Assistant Secretary of the Treasury for Financial Stability

- appointment of a Special Master for TARP Executive Compensation

- creation of a Treasury position for restructuring/exit strategy

- appointment of three asset managers

Assistant Secretary

On June 19, 2009, Herbert Allison was confi rmed by the U.S. Senate to be the Assistant Secretary of the Treasury for Financial Stability, replacing Neel Kashkari, who served on an interim basis. In this role, Mr. Allison is responsible for “developing

and coordinating Treasury’s policies on legislative and regulatory issues affecting fi nancial stability, including overseeing the Troubled Asset Relief Program (TARP).” He will also have the title of Counselor to the Secretary.Special Master for TARP Executive Compensation

On June 10, 2009, the President announced plans to appoint Kenneth Feinberg as the Special Master for TARP Executive Compensation, to “ensure compensation plans are consistent with the public interest.” As mentioned previously in

the “Executive Compensation” discussion in Section 2: “TARP Overview,” Mr. Feinberg, whose mediation experience includes acting as the Special Master of the September 11th Victim Compensation Fund, “will review payments and compensation

plans for the executives and the 100 most highly compensated employees of TARP recipients that have received exceptional assistance to ensure that compensation is structured in a way that gives those employees incentives to maximize long-term shareholder value and protect taxpayer interests.” Companies receiving exceptional fi nancial assistance include those receiving assistance under the Systemically Significant Failing Institutions (“SSFI”), the Targeted Investment Program (“TIP”), and the Automotive Industry Financing Program (“AIFP”), and currently include the American International Group (“AIG”), Citigroup, Bank of America, Chrysler, General Motors (“GM”), GMAC and Chrysler Financial.