Solomon Islands Financial Intelligence Unit (SIFIU)

Solomon Islands Financial Intelligence Unit (SIFIU)

- 11 pages

- Confidential

- 2008

Introduction

Guided by the 40+9 Recommendations of the Financial Action Task Force (FATF), the Solomon Islands Government has established systems to prevent money laundering and the financing of terrorism. These systems include the creation of:

• The Solomon Islands Financial Intelligence Unit (SIFIU) – comprising

the Head of SIFIU, a Compliance Officer and, more recently, a Financial

Analyst on part-time secondment from the RSIP.• New sources of financial intelligence – all banks are required by law to

report suspicious transactions to the SIFIU. Since 2006, banks have

reported over [x] Suspicious Transaction Reports. Assisted by SIFIU,

banks are required to train staff to recognise and report suspicious

transactions and to appoint a Money Laundering Compliance Officer

(MLRO). Key new sources of financial intelligence to commence in 2009

include Western Union Money Transfer Service, and Customs and

Immigration will commence monitoring and reporting currency

movements across the border of $50,000 or more in Solomon Islands

Dollars (or foreign currency equivalent). Casinos will also be required to

identify and report suspicious transactions in 2009.• An Anti-Money Laundering Committee – comprising the Attorney-

General (Chair), the Permanent Secretary of Finance, the Police

Commissioner, and the Governor of the Central Bank of Solomon Islands

(CBSI)• A Technical Working Group – comprising representatives from RSIP,

Immigration, Customs, CBSI, and the SIFIU.Having created the basic infrastructure to prevent financial crime and money

laundering, it is timely to improve the targeting of that infrastructure to detect

and disrupt the most serious financial crimes harming the Solomon Islands.

The purpose of this risk assessment is to improve the detection and

disruption of serious financial crime by:• Identifying the major types of financial crime generating funds to be

laundered• Mapping the ‘money trail’ used to launder those funds – either in

Solomon Islands or elsewhere• Educating banks and other financial service providers about the

major sources of financial crime, how to recognise transactions associated

with such crimes, and to better understand the associated ‘money trails’.• Identifying priorities for further research – particular types of risk

require further research and analysis to improve detection and disruption

of serious financial crime.…

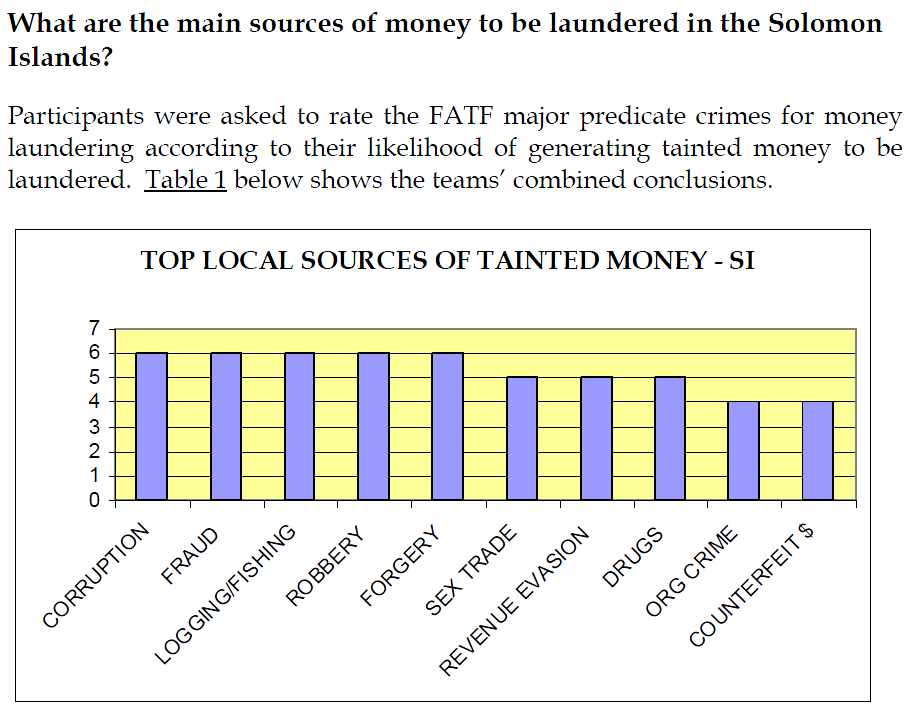

Key points of team presentations and discussion are summarised below:

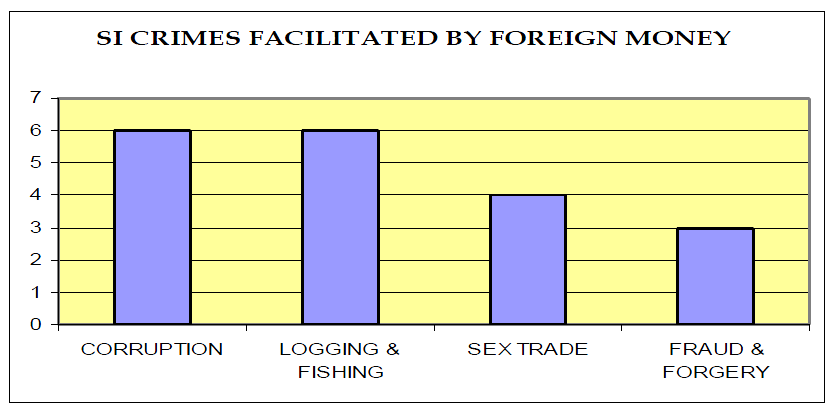

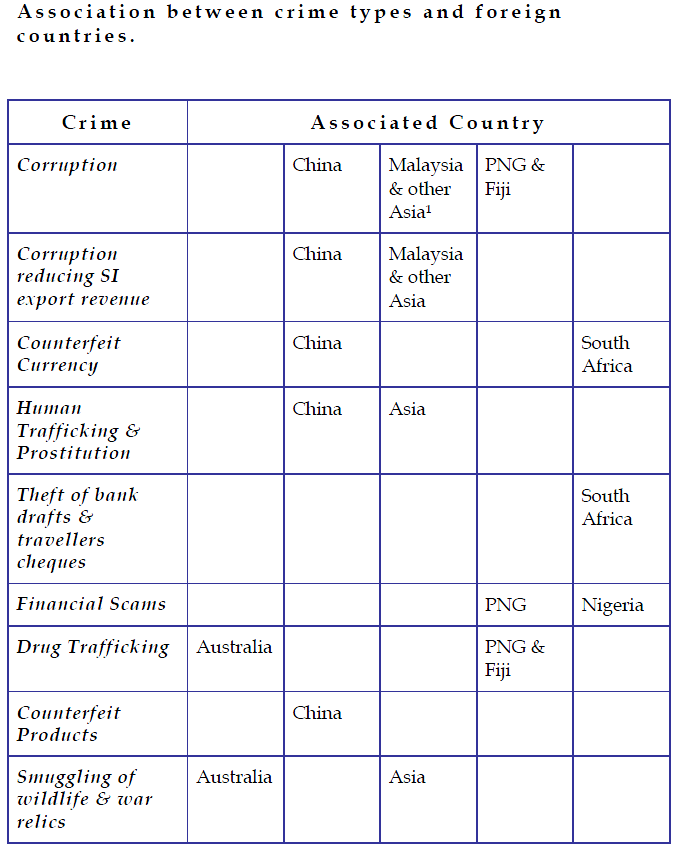

• Corruption: participants noted widespread misuse of official funds, or

office, for private financial gain. Numerous Auditor-General reports

found that corruption is facilitated by widespread non-compliance with

financial legislation and regulations; officials acting outside their

authority; serious breakdown in critical management, accounting and

record keeping systems; proliferation of unauthorised government bank

accounts (over 300); and conflicts of interest not being declared.• Fraud, forgery and revenue evasion: millions of dollars are lost

through fraud by government employees; officials using positions of

influence to assist associates to receive benefits; lack of action to enforce

revenue collection or to recover overpayments, with suspected criminal

activity (eg. royalties diverted to private accounts). Concern about land

allocations, the issuance of immigration passports and citizenship, and

abuse of aviation revenue.• Environmental crime: participants noted that illegal logging causes

unsustainable deforestation, harms local communities, generates large

sums to be laundered, and is a major driver of corruption. ‘Hundreds of

millions’ has been lost in foregone forestry and fisheries revenue.

Suspicion persists that foreign vessels are a platform for smuggling SI wildlife to international markets (eg snakes and endangered parrots).

Smuggling of SI dolphins for use in marine entertainment parks can be

especially lucrative – fetching between $800,000 – $1.6m SBD each.

Participants were also concerned by smuggling of SI war relics.• Counterfeit products and cash: sales of counterfeit music and movies

are common. Central Bank of Solomon Islands has repeatedly detected

counterfeit SI $50 and $100 notes (eg. 2004, 2007 and 2008). CBSI has also

detected counterfeit US dollars. There is suspicion that Asian logging

vessels (particularly Malaysian) bring counterfeit currency into Solomon

Islands to finance forestry operations.• Sexual exploitation: concern was expressed about trafficking Asian

women into Solomon Islands for prostitution, as allegedly occurs in

neighbouring PNG. Important clientele were considered to be casino and

nightclub patrons, and employees of logging and fishing industries. There

are also reports of Solomon Islands women and girls entering prostitution

in Honiara and in forestry camps.• Illicit drugs: cannabis production and sale is common. There are

suspicions that cannabis is also smuggled from PNG to Solomon Islands.…